Silver Surge 2025: Global Market Rally Meets Indian Mutual Fund Boom—Your Next Big Investment?

Silver prices are soaring in 2025, with Indian investors turning to silver ETFs for growth, diversification, and inflation protection. Here’s why silver may be your next smart investment.

Silver investment in 2025 is making headlines, with both global and Indian markets witnessing a dramatic surge. This blog explores the latest silver price trends, the macroeconomic and industrial forces at play, and why Indian mutual fund investors are flocking to silver ETFs for portfolio diversification and inflation protection.

Global Silver Market Trends 2025: Why Silver Prices Are Rising

Silver prices have soared globally over the past year, reflecting a powerful combination of macroeconomic shifts and robust industrial demand:

- Global Rally: Silver jumped from $23/oz in early 2024 to nearly $36/oz by mid-2024. In early 2025, silver is trading near $34/oz, marking a 14% rally year-to-date by March.

- Bullish Forecasts: Analysts predict silver could reach $35–$56/oz in 2025, with some even more optimistic.

- US Dollar Index Impact: The US Dollar Index dropped from 104 to just above 100, making silver more attractive for global buyers and fueling the price rally.

- Industrial Demand: Silver is essential for solar panels, electric vehicles (EVs), and electronics. Solar energy alone could consume up to 98% of global silver reserves by 2050.

- Supply Deficit: The silver market is in its fifth consecutive year of deficit, with demand outpacing supply and supporting higher prices.

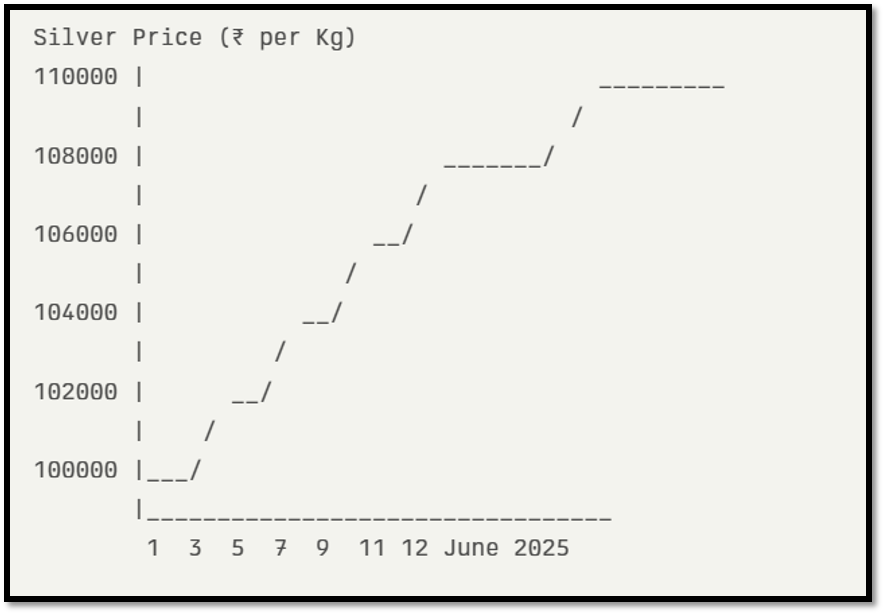

Indian Silver Market: Record Highs and Strong Demand

- Sharp Price Rise: In Ahmedabad, silver rates surged from ₹99,900/kg on June 1, 2025, to ₹1,08,900/kg by June 12, 2025—a 9% increase in less than two weeks.

- Nationwide Trend: Major cities like Mumbai, Delhi, and Bangalore also reported prices around ₹1,08,900/kg, reflecting strong pan-India demand.

- Volatility & Opportunity: After peaking at ₹1,09,000/kg on June 10, prices stabilized, showing robust demand and healthy market momentum.

June 2025 Silver Price Table (India)

|

Date |

Silver Price per Kg (₹) |

Change (₹) |

% Change (Approx.) |

|

June 1, 2025 |

99,900 |

— |

— |

|

June 3, 2025 |

1,00,100 |

+200 |

+0.20% |

|

June 4, 2025 |

1,02,000 |

+1,900 |

+1.90% |

|

June 5, 2025 |

1,04,000 |

+2,000 |

+1.96% |

|

June 6, 2025 |

1,07,000 |

+3,000 |

+2.88% |

|

June 7, 2025 |

1,07,000 |

0 |

0% |

|

June 8, 2025 |

1,07,000 |

0 |

0% |

|

June 9, 2025 |

1,08,000 |

+1,000 |

+0.93% |

|

June 10, 2025 |

1,09,000 |

+1,000 |

+0.93% |

|

June 11, 2025 |

1,09,000 |

0 |

0% |

|

June 12, 2025 |

1,08,900 |

-100 |

-0.09% |

Key Highlights:

- 9.01% gain in just 10 days (June 1–10, 2025)

- Strong demand and bullish momentum in Indian silver markets

- Minor corrections reflect normal market activity

The Dollar-Silver Connection: A Key Investment Insight

- Inverse Relationship: As the US Dollar weakens, silver becomes cheaper for global buyers, driving up demand and prices.

- Safe Haven Appeal: Silver is increasingly sought as a hedge against inflation and currency depreciation, especially during economic uncertainty.

Industrial Demand: The Growth Engine for Silver in 2025

- Green Technology: Silver is vital for renewable energy, EVs, and electronics.

- Automotive Sector: Electrification and infrastructure growth are fueling silver consumption.

- Sustained Demand: Despite a minor expected dip in total demand, industrial use remains at record highs.

Silver ETFs in India: Mutual Fund Market Sees Explosive Growth

- AUM Surge: Assets under management (AUM) in Indian silver ETFs soared by 125% in one year, from ₹7,473 crore (June 2024) to ₹16,866 crore (May 2025).

- Rising Investors: Silver ETF folios grew from 6 lakh in January 2025 to 8.37 lakh by May 2025.

- Popular Silver ETFs:

- Nippon India ETF Silver BeES

- ICICI Prudential Silver ETF

- HDFC Silver ETF

Why Indian Investors Are Flocking to Silver Mutual Funds

- Diversification: Silver offers a unique blend of precious metal and industrial commodity exposure.

- Inflation Hedge: Like gold, silver protects against inflation and currency volatility.

- Accessibility: Silver ETFs make it easy for Indian investors to participate in the global silver rally.

How to Use Silver in Your Portfolio: Strategy for 2025

- Tactical Allocation: Due to higher volatility, silver funds are best used as a tactical, not core, allocation.

- Growth & Diversification: Ideal for investors seeking both portfolio diversification and potential for high returns.

- Consultation Advised: Always consult a financial advisor to match silver investments with your risk profile.

Conclusion: Silver’s Essential Role in a Future-Ready Portfolio

With soaring global prices, robust industrial demand, and record inflows into Indian silver ETFs, silver is poised to remain a top investment story in 2025. Its dual nature—as both a store of value and a strategic industrial asset—makes silver a vital component for those seeking growth, diversification, and inflation protection.

Don’t miss out on the silver surge—consider adding silver ETFs or mutual funds to your investment portfolio today!

Silver ETF Performance: Easy to choose

|

Scheme Name |

AuM (Cr) |

1W |

1M |

3M |

6M |

YTD |

1Y |

|

Nippon India Silver ETF |

6,635.73 |

4% |

10% |

9% |

13% |

22% |

19% |

|

ICICI Prudential Silver ETF |

5,333.32 |

4% |

10% |

9% |

14% |

22% |

19% |

|

Kotak Silver ETF |

1,221.04 |

4% |

10% |

9% |

13% |

22% |

19% |

|

SBI Silver ETF |

791.30 |

4% |

10% |

9% |

13% |

22% |

- |

|

HDFC Silver ETF |

702.56 |

4% |

10% |

8% |

14% |

22% |

20% |

|

Aditya Birla Sun Life Silver ETF |

668.26 |

4% |

10% |

9% |

14% |

22% |

19% |

|

DSP Silver ETF |

576.75 |

4% |

10% |

9% |

13% |

22% |

19% |

|

Axis Silver ETF |

216.47 |

4% |

10% |

9% |

14% |

22% |

20% |

|

UTI Silver Exchange Traded Fund |

210.40 |

4% |

10% |

8% |

14% |

23% |

18% |

|

Tata Silver Exchange Traded Fund |

190.95 |

5% |

10% |

9% |

12% |

21% |

18% |

|

Edelweiss Silver ETF |

175.75 |

4% |

10% |

9% |

13% |

22% |

19% |

|

Mirae Asset Silver ETF |

95.12 |

4% |

10% |

9% |

14% |

22% |

19% |

|

Zerodha Silver ETF |

18.21 |

4% |

10% |

- |

- |

- |

- |

|

360 ONE Silver ETF |

7.02 |

4% |

10% |

- |

- |

- |

- |

|

Groww Silver ETF |

0.00 |

4% |

- |

- |

- |

- |

- |

|

NAV &

Returns data as on: 11-Jun-25 |

|||||||

References

- GoodReturns.in – Silver price data, June 2025

- GoldSilver.com – Silver price outlook and industrial demand, 2025

- Mining.com – Global silver supply-demand report, 2025

- Predict-Price.com – Silver price forecasts for 2025

- IG.com – Silver price rally analysis, March 2025

Disclaimer:

The content provided in these blogs is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy, sell, or hold any mutual fund, scheme, or security. The discussions and analyses are intended solely to foster awareness and understanding of various market situations and financial products. The information presented is based on publicly available data and sources believed to be reliable; however, its accuracy or completeness is not guaranteed.

Readers are expressly advised that they should seek independent professional advice from a qualified financial advisor before making any investment decisions. The author(s) and publisher of these blogs expressly disclaim any liability for any direct or indirect loss or damage of any kind arising out of or in connection with the use of or reliance on any information contained herein. Past performance is not indicative of future results, and all investments are subject to market risks.