Rare Earth Magnet Crunch: Is Your Auto Portfolio Ready for the Shock? What Indian Investors Should Watch in Auto Stocks

China’s rare earth curbs hit Indian EVs and auto stocks. See how it impacts mutual funds and your portfolio in 2025.

Rare earth magnets are high-performance permanent magnets made from alloys of rare earth elements such as neodymium (Nd), samarium (Sm), and dysprosium (Dy)12. These magnets are renowned for their exceptional magnetic strength, high energy density, and ability to generate strong magnetic fields in compact sizes—qualities that make them indispensable in modern technology and especially in the automotive sector134. In electric vehicles (EVs) and hybrid vehicles, rare earth magnets are crucial for powering motors, sensors, power steering, braking systems, and a host of other components that demand both efficiency and compactness356. A magnet the size of a coin can move heavy car parts quickly and precisely, demonstrating their outsized impact on automotive innovation5.

China’s Export Restrictions and the Supply Chain Crisis

China controls about 90% of the world’s rare earth magnet processing and has recently tightened export restrictions, requiring special licenses for seven out of seventeen key rare earths15. This move is already disrupting global supply chains, with the Indian auto industry among the hardest hit. India, while possessing its own rare earth reserves, lacks the advanced processing infrastructure to meet domestic demand, making it heavily reliant on Chinese imports15.

Impact on India’s Auto Sector

The Indian automotive sector, especially the rapidly growing EV segment, is particularly exposed to this supply shock. Rare earth magnets are essential for the efficiency and miniaturization of electric motors, which are at the heart of EVs36. With China’s export restrictions, Indian manufacturers face:

- Production Delays and Cost Escalation: Shortages of rare earth magnets can halt production lines, as seen globally with companies like Suzuki. Indian automakers are warning of similar risks, with inventories running thin and new supplies uncertain5.

- Redesign and Sourcing Challenges: China’s push to sell entire motor assemblies instead of just magnets could force Indian automakers to redesign vehicles, increasing costs and time-to-market5.

- Threat to EV Adoption: Higher costs and potential delays could slow down India’s EV transition, impacting government targets and the competitiveness of Indian auto exports36.

- Long-term Vulnerability: The lack of local processing capability means India remains exposed to future supply shocks unless significant investments are made in domestic rare earth value chains1.

Top Indian Auto Stocks at Risk

Several leading auto and auto ancillary companies, widely held in Indian mutual fund portfolios, are likely to feel the impact of the rare earth magnet crunch. These include:

- Tata Motors

- Mahindra & Mahindra

- Maruti Suzuki

- Bajaj Auto

- Hero MotoCorp

- Motherson Sumi Systems

- Bosch Ltd

- Sona BLW Precision Forgings

- Endurance Technologies

- Exide Industries

These companies are prominent in diversified equity funds, sectoral auto funds, and thematic manufacturing funds, making the ripple effects of supply chain disruptions a concern for mutual fund investors.

Top Mutual Fund Schemes with High Allocation to Auto Stocks

|

Mutual Fund

Scheme Name |

Type |

Notable

Auto Holdings (examples) |

|

Nippon India Nifty Auto ETF |

Index/Thematic |

Tata Motors, Mahindra &

Mahindra, Maruti Suzuki, Bajaj Auto, Hero MotoCorp, Bosch Ltd, Motherson

Sumi, Exide Ind. |

|

SBI

Automotive Opportunities Fund |

Sectoral/Active |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd, Endurance

Tech, Exide Ind. |

|

ICICI Prudential Nifty Auto

Index Fund |

Index |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Motherson Sumi, Bosch

Ltd, Exide Ind. |

|

TATA Nifty

Auto Index Fund |

Index |

Tata Motors, Maruti Suzuki, Mahindra

& Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd, Sona BLW, Endurance

Tech |

|

UTI Transportation and Logistics

Fund |

Thematic |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd, Motherson

Sumi, Exide Ind. |

|

HDFC Auto

& Auto Ancillaries Fund |

Sectoral/Active |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd, Endurance

Tech, Exide Ind. |

|

Aditya Birla Sun Life

Transportation and Logistics Fund |

Thematic |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd, Motherson

Sumi, Exide Ind. |

Key Notes:

- These schemes, especially the index and sectoral/thematic funds, track the Nifty Auto Index or maintain a concentrated portfolio of leading auto and auto ancillary stocks123.

- The above funds typically have high exposure to the stocks you listed, as these companies are major constituents of the Nifty Auto Index and are leaders in their respective segments.

- Actively managed funds like SBI Automotive Opportunities Fund and HDFC Auto & Auto Ancillaries Fund may adjust allocations based on market outlook and sector trends.

Always refer to the latest fund factsheets or disclosures for the most current portfolio holdings and weightage.

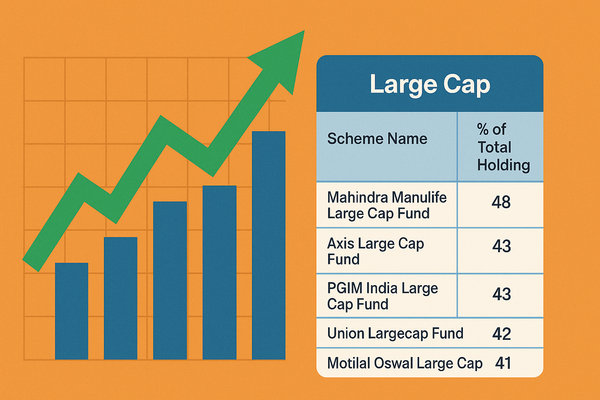

You can find significant allocations to major Indian auto and auto ancillary stocks (like Tata Motors, Mahindra & Mahindra, Maruti Suzuki, Bajaj Auto, Hero MotoCorp, Motherson Sumi Systems, Bosch Ltd, Sona BLW Precision Forgings, Endurance Technologies, and Exide Industries) in several diversified equity mutual fund schemes—not just sectoral or thematic auto funds. Here are some notable examples from large cap, multi cap, and flexi cap categories:

|

Mutual Fund

Scheme Name |

Category |

Notable

Auto Holdings (examples) |

|

ICICI Prudential Bluechip Fund |

Large Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd, Motherson Sumi |

|

SBI

Bluechip Fund |

Large Cap |

Tata Motors, Mahindra &

Mahindra, Maruti Suzuki, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

Mirae Asset Large Cap Fund |

Large Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

HDFC Top

100 Fund |

Large Cap |

Tata Motors, Mahindra &

Mahindra, Maruti Suzuki, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

Nippon India Large Cap Fund |

Large Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

Motilal

Oswal Flexi Cap Fund |

Flexi Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

Parag Parikh Flexi Cap Fund |

Flexi Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra |

|

ICICI

Prudential Multicap Fund |

Multi Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd, Motherson Sumi |

|

Quant Active Fund |

Multi Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

HDFC Equity

Fund |

Multi Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

Mutual Fund Scheme Name |

Category |

Notable Auto Holdings (examples) |

|

ICICI

Prudential Bluechip Fund |

Large Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd, Motherson Sumi |

|

SBI Bluechip Fund |

Large Cap |

Tata Motors, Mahindra &

Mahindra, Maruti Suzuki, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

Mirae Asset

Large Cap Fund |

Large Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

HDFC Top 100 Fund |

Large Cap |

Tata Motors, Mahindra &

Mahindra, Maruti Suzuki, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

Nippon

India Large Cap Fund |

Large Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

Motilal Oswal Flexi Cap Fund |

Flexi Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

Parag

Parikh Flexi Cap Fund |

Flexi Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra |

|

ICICI Prudential Multicap Fund |

Multi Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd, Motherson Sumi |

|

Quant

Active Fund |

Multi Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

|

HDFC Equity Fund |

Multi Cap |

Tata Motors, Maruti Suzuki,

Mahindra & Mahindra, Bajaj Auto, Hero MotoCorp, Bosch Ltd |

Key Points:

- These diversified funds often have substantial exposure to leading auto and auto ancillary stocks as part of their core equity portfolios, reflecting the sector’s weight in major indices and its importance to India’s economy.

- The exact allocation to each stock will vary by fund and over time, so it is advisable to check the latest factsheet or portfolio disclosure for up-to-date holdings.

References:

Funds and holdings information are based on recent disclosures and fund factsheets from leading fund houses and mutual fund research platforms2356.

For the most current and detailed allocation, always review the latest monthly portfolio disclosures from the respective fund houses.

How the Mutual Fund Sector Is Responding

Indian mutual funds are closely monitoring these developments and taking proactive measures to manage risk and protect investor interests:

- Dynamic Portfolio Management: Fund managers are reassessing sectoral allocations, potentially reducing exposure to auto and auto ancillary stocks most vulnerable to supply chain disruptions.

- Focus on Resilience: There is a growing preference for companies with diversified sourcing, strong R&D, or those investing in alternative motor technologies less dependent on rare earth magnets.

- Thematic Shifts: Some funds are increasing allocations to sectors less affected by the rare earth crisis, such as IT, FMCG, and pharmaceuticals, to balance portfolio risk.

- Investor Communication: Fund houses are enhancing disclosures and investor education around supply chain risks, ensuring investors are aware of the potential impact on fund performance.

Conclusion

The rare earth magnet crisis is a wake-up call for India’s auto industry and its investors. As China tightens its grip on critical materials, the need for domestic capability and supply chain resilience has never been clearer. For mutual fund investors, this is a reminder of the importance of diversification and the value of active fund management in navigating global disruptions. While the short-term impact may be volatility in auto sector-heavy funds, the long-term response will shape the future of India’s manufacturing and investment landscape135.

Disclaimer:

The content provided in these blogs is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy, sell, or hold any mutual fund, scheme, or security. The discussions and analyses are intended solely to foster awareness and understanding of various market situations and financial products. The information presented is based on publicly available data and sources believed to be reliable; however, its accuracy or completeness is not guaranteed.

Readers are expressly advised that they should seek independent professional advice from a qualified financial advisor before making any investment decisions. The author(s) and publisher of these blogs expressly disclaim any liability for any direct or indirect loss or damage of any kind arising out of or in connection with the use of or reliance on any information contained herein. Past performance is not indicative of future results, and all investments are subject to market risks.