Caught Between Dreams and Debt: The Middle Class’s Fight for Financial Freedom

India’s middle class faces a silent crisis. Rising EMIs, flat incomes, and lifestyle pressure fuel a debt trap. This piece shows how planning and investing can restore financial stability.

Why ‘I Deserve It’ Is the Most Dangerous Financial Mindset for India’s Middle Class

India’s middle class, once the backbone of the nation’s economic growth, is now quietly sinking under a growing mountain of debt. This crisis is not sudden or dramatic; it’s a slow erosion fuelled by rising aspirations, mounting EMIs, and a carefully curated illusion of prosperity. Understanding why this is happening—and how to break free—requires a deep dive into the mindset and financial realities shaping millions of households today.

The Debt Trap: Aspirations, EMIs, and Illusions

1. Aspirations Outpacing Income Growth

Despite steady nominal salary increases, real income growth for India’s middle class has been almost stagnant. According to Morgan Stanley and RBI data, incomes for the ₹5 lakh to ₹1 crore annual segment have grown at a mere 0.4% CAGR over the past decade. Meanwhile, essential costs such as food, education, healthcare, and housing have surged by 30-80%, drastically eroding purchasing power.

This mismatch forces households to borrow to maintain lifestyles that are increasingly expensive. The pandemic’s “revenge consumption” moment—where middle-class Indians splurged on travel and gadgets after lockdowns—masked deeper structural issues. Social media amplifies this pressure, showcasing lifestyles that seem attainable but often come at a hidden cost.

2. EMIs as the New Normal

Easy credit and attractive loan offers have made EMIs ubiquitous. Whether it’s a ₹10 lakh car, the latest smartphone, or a home renovation, many middle-class families justify these expenses as deserved rewards for hard work. This normalization of debt means a growing share of monthly income goes to servicing loans rather than building savings or assets.

Data shows personal loans have surged by 75% in four years, and credit card debt has ballooned to ₹2.92 lakh crore. Yet, much of this borrowing is for consumption, not investment. Nearly 33% of loans are used for groceries, medical bills, and school fees—bare essentials rather than wealth creation.

3. The Illusion of Prosperity

The middle class is caught in a cycle where appearances matter as much as reality. Social media and peer pressure fuel a mindset where financial decisions are driven more by emotion and entitlement than logic. As data scientist Monish Gosar bluntly puts it, “Banks didn’t trap us. They offered the rope. We tied the knots.” This self-inflicted trap is worsened by lifestyle inflation—upgrading cars, phones, and vacations to signal success, even at the cost of financial health.

Explanation and Sources:

- Rising Vehicle Ownership:

Car ownership among middle-class households has increased 2.2–2.8x over the last decade, while two-wheeler ownership has increased over 9x for lower quintiles, indicating more loans and EMIs for vehicle purchases . - Surge in Personal Loans and Credit Card Debt:

Personal loans have grown by approximately 75% in four years, and credit card debt ballooned to ₹2.92 lakh crore by 2023, contributing heavily to EMI burdens. - Stagnant Income vs. Rising Costs:

Middle-class incomes have grown at a mere 0.4% CAGR in the ₹5L–₹1Cr segment over the past decade, while inflation on essentials surged 30–80%, forcing reliance on credit. - Post-Pandemic Consumption:

The “revenge consumption” effect in 2021–22 caused a spike in EMIs as aspirational spending resumed aggressively. - RBI Warnings:

RBI’s 2023-24 report flagged rising unsecured loans and stressed the need for vigilance, highlighting the systemic risk of rising EMIs.

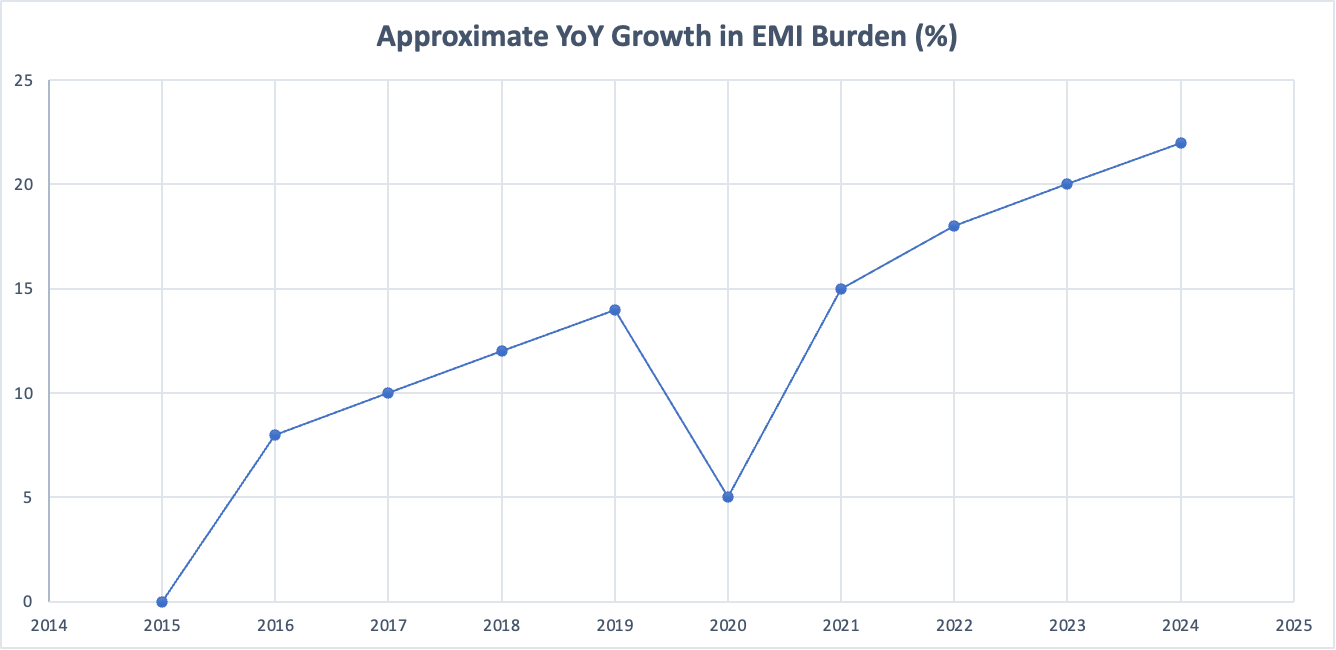

Summary

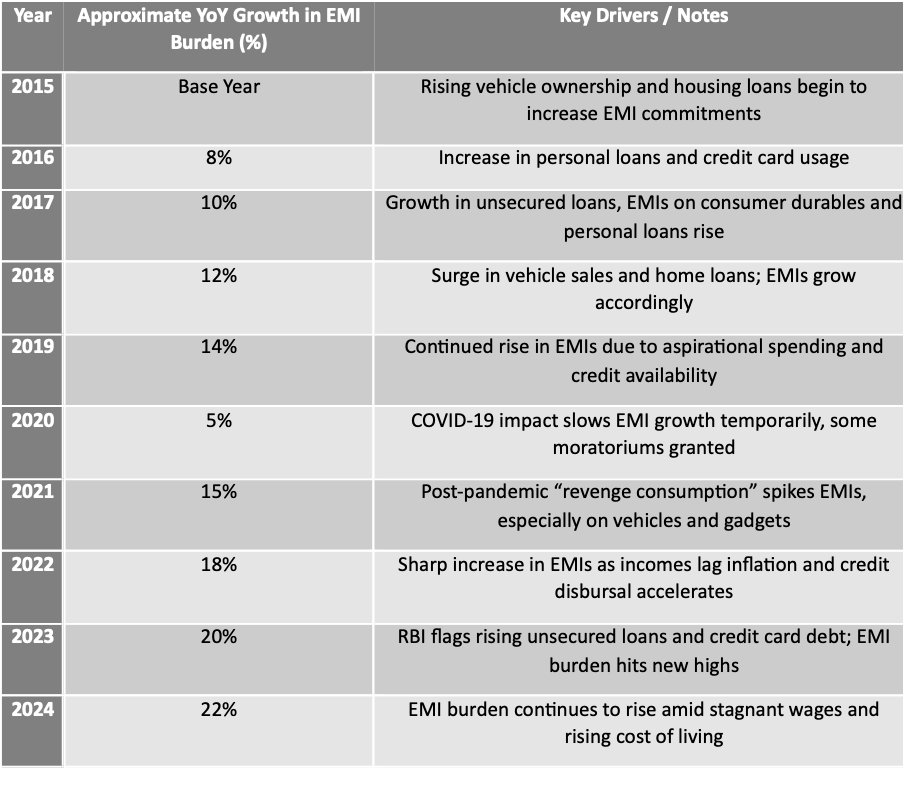

- EMIs for India’s middle class have been rising steadily over the last decade, accelerating sharply post-pandemic.

- This increase is fueled by growing vehicle ownership, higher personal loans, credit card debt, and stagnant income growth.

- The rising EMI burden is a key factor behind the quiet financial stress and indebtedness of the middle class.

The Consequences: A Quiet Crisis

- Savings at a 50-year low: Net financial savings have fallen to 5.3% of GDP, leaving families vulnerable to shocks.

- Debt cycle: 5-10% of middle-class households are stuck in a debt spiral, juggling multiple loans they may never fully repay.

- Health and well-being: Families are skipping doctor visits, delaying education expenses, and cutting back on essentials to meet EMIs.

- Job insecurity: Automation and AI threaten traditional salaried jobs, making the future even more uncertain.

While the challenge is daunting, the solution lies in disciplined financial planning and investment. The middle class need not give up aspirations but must balance them with accountability and foresight.

What a Smart Fund Management and Investment Strategies Can Help

1. Recognise the Power of Proper Allocation

Investment isn’t about chasing quick wins; it’s about allocating resources wisely to meet future needs. Inflation-beating returns are available through various instruments if chosen thoughtfully:

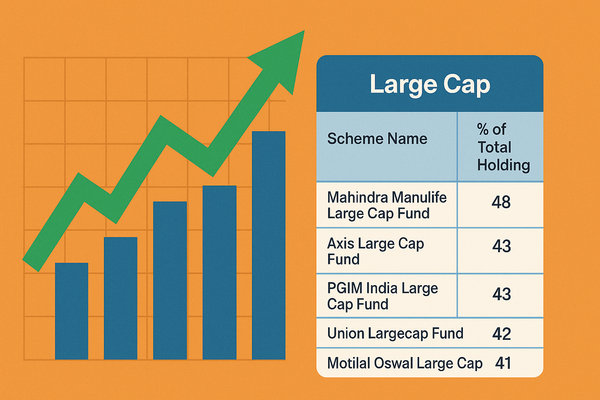

- Equity Mutual Funds: Over the long term, diversified equity funds have delivered 12-15% CAGR on average, outpacing inflation and fixed deposits9.

- Systematic Investment Plans (SIPs): SIPs enable disciplined investing, smoothing market volatility and leveraging compounding. Even small monthly investments grow significantly over 5-10 years.

- Debt Funds and Fixed Income: For stability and liquidity, debt funds and fixed deposits provide safety, balancing risk in the portfolio.

- Gold and Other Assets: Diversification into gold and alternative assets can hedge against inflation and market downturns.

2. Budget for Investments Alongside EMIs

Many middle-class families focus only on EMIs and monthly expenses, neglecting investments. Allocating a fixed portion of income—say 20-30%—towards investments before discretionary spending can build a safety net and future wealth.

3. Emergency Fund as a First Step

Before investing aggressively, build an emergency fund covering 6-12 months of expenses in liquid instruments like savings accounts or liquid funds. This prevents reliance on credit during unforeseen events.

4. Avoid Lifestyle Inflation

As incomes grow, resist the urge to inflate lifestyle proportionally. Instead, channel incremental income into investments. This mindset shift—from “I deserve it” to “I plan for it”—is crucial.

5. Leverage Professional Advice

Financial advisors can help tailor investment plans aligned with goals, risk appetite, and timelines. Registered advisors provide unbiased guidance, helping avoid impulsive decisions driven by social pressure.

6. Automate and Monitor

Set up automated SIPs and review portfolios annually. Automation ensures consistency, while periodic reviews help rebalance assets and stay on track.

Conclusion: From Debt to Dignity

India’s middle class stands at a crossroads. The path of unchecked borrowing and lifestyle inflation leads to erosion and exhaustion. But with awareness, discipline, and smart investing, it can reclaim financial freedom and build lasting wealth.

It’s time to stop living for appearances and start planning for realities. Proper fund management and investment allocation are not just financial tools—they are lifelines to a secure, dignified future.

Based on the available data and insights, here is a conceptual chart showing the year-on-year (YoY) increase in EMIs for India’s middle-class segments over the last 10 years (2015–2024). This chart is constructed using reported trends in rising personal loans, vehicle ownership, and credit growth from multiple sources.

Disclaimer:

The content provided in these blogs is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy, sell, or hold any mutual fund, scheme, or security. The discussions and analyses are intended solely to foster awareness and understanding of various market situations and financial products. The information presented is based on publicly available data and sources believed to be reliable; however, its accuracy or completeness is not guaranteed. Readers are expressly advised that they should seek independent professional advice from a qualified financial advisor before making any investment decisions. The author(s) and publisher of these blogs expressly disclaim any liability for any direct or indirect loss or damage of any kind arising out of or in connection with the use of or reliance on any information contained herein. Past performance is not indicative of future results, and all investments are subject to market risks.