How Skipping Health Insurance Can Shatter Your Family’s Wealth—Protect What You’ve Built Before It’s Too Late

One medical emergency can wipe out your savings. Learn why health insurance is essential in 2025 and how to protect your long-term wealth.

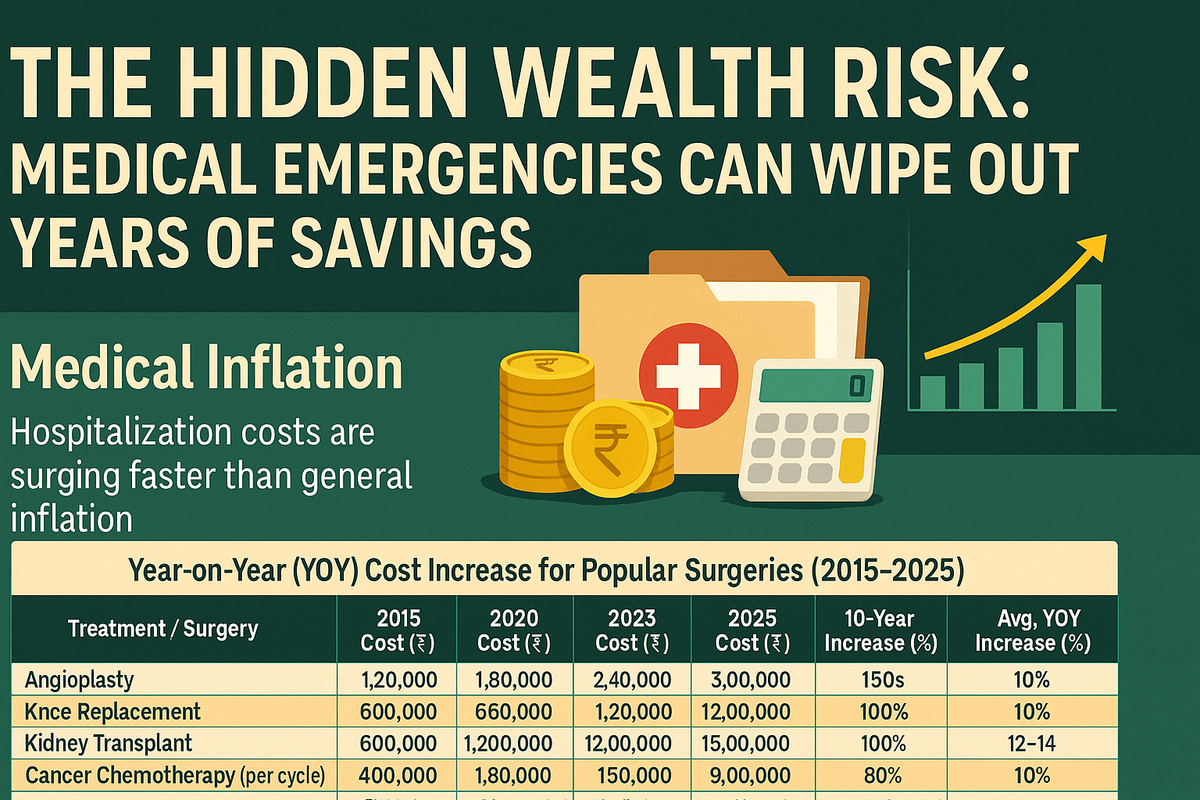

The Hidden Wealth Risk: Medical Emergencies Can Wipe Out Years of Savings

In India, a single hospitalization can devastate a family’s finances, erasing years of hard-earned savings and investments. With medical inflation consistently outpacing general inflation, the risk to your long-term wealth is greater than ever. Let’s look at how rapidly treatment costs are rising—and why comprehensive health insurance is now a non-negotiable part of financial planning. If you understand this, you can easily accept even the increase of health insurance premium

Medical Inflation: Hospitalization Costs Are Surging Faster Than General Inflation

- Healthcare costs in India are projected to rise by 13% in 2025—higher than the global average and much faster than typical consumer inflation.

- Advanced treatments, a surge in non-communicable diseases, and a shortage of quality healthcare infrastructure are driving costs higher every year.

- Without adequate health insurance, families are forced to dip into savings, liquidate assets, or take loans to pay for treatment.

Year-on-Year (YOY) Cost Increase for Popular Surgeries (2015–2025)

|

Treatment / Surgery |

2015 Cost (₹) |

2020 Cost (₹) |

2023 Cost (₹) |

2025 Cost (₹) |

10-Year Increase (%) |

Avg. YOY Increase (%) |

|

Angioplasty |

1,20,000 |

1,80,000 |

2,40,000 |

3,00,000 |

150% |

10–12% |

|

Knee Replacement |

2,00,000 |

2,60,000 |

3,20,000 |

4,00,000 |

100% |

8–10% |

|

Kidney Transplant |

6,00,000 |

9,00,000 |

12,00,000 |

15,00,000 |

150% |

12–14% |

|

Cancer Chemotherapy (per cycle) |

40,000 |

60,000 |

80,000 |

1,00,000 |

150% |

12–14% |

|

Heart Bypass Surgery |

2,50,000 |

3,50,000 |

4,50,000 |

5,50,000 |

120% |

9–11% |

Source: Statista, Financial Express, industry estimates

Why Are Medical Costs Outpacing General Inflation?

- Advanced technologies and drugs are more expensive and widely used.

- Lifestyle diseases (heart disease, cancer, diabetes) are on the rise, requiring frequent and costly treatments.

- Shortage of quality healthcare infrastructure and skilled professionals drives up service costs.

How Much Health Insurance Is Enough for Your Family in 2025?

|

Family Type |

Metro/Tier-1 City |

Tier-2 City |

Tier-3 City |

|

Individual |

₹10 lakh+ |

₹5–10 lakh |

₹5 lakh |

|

Family Floater |

₹30 lakh+ |

₹20 lakh+ |

₹10 lakh+ |

|

Senior Citizen |

₹20 lakh+ |

₹15 lakh+ |

₹10 lakh+ |

- For a family of four in a metro city, a minimum cover of ₹20–30 lakh is recommended.

- Consider top-up or super top-up plans for extra protection.

Let’s understand with an example that whether you are ready to accept 20/25% loss of your portfolio or not.

Here’s a clear chart summarizing the impact of a ₹15 lakh withdrawal to pay hospitalization expenses in December 2020 from an investment that began in January 2015 with a ₹10 lakh lumpsum and a ₹20,000 monthly SIP, assuming a 12% annual return. The chart shows portfolio values as of 2030 and 2035, with and without the withdrawal, and the resulting wealth loss:

Impact of ₹15 Lakh Withdrawal on Long-Term Investment Growth

|

Year |

Scenario |

Portfolio Value (₹) |

Wealth Lost Due to

Withdrawal (₹) |

|

2030 |

No Withdrawal |

1,92,70,000 |

– |

|

2030 |

With ₹15L Withdrawal |

1,49,70,000 |

43,00,000 |

|

2035 |

No Withdrawal |

3,64,90,000 |

– |

|

2035 |

With ₹15L Withdrawal |

2,80,90,000 |

84,00,000 |

Key Insight:

A single large withdrawal for hospitalization can reduce your long-term wealth by ₹43 lakh in 2030 and by ₹84 lakh in 2035, highlighting the critical importance of health insurance for protecting your investment growth.

Where to Buy the Best Health Insurance in India

- Top Insurers: HDFC ERGO, ICICI Lombard, Star Health, Max Bupa, Apollo Munich, and more.

- Online Platforms: PolicyBazaar, Coverfox, or direct insurer websites for easy comparison and purchase.

- What to Look For: Comprehensive hospitalization cover, cashless network hospitals, no-claim bonus, critical illness riders, and coverage for advanced treatments.

Conclusion: Don’t Let Medical Inflation Destroy Your Wealth—Act Now

With hospitalization and treatment costs rising at double-digit rates every year, health insurance is no longer optional. It’s your financial shield against the unpredictable and ever-increasing burden of medical expenses. Protect your family’s future and your long-term wealth—review and upgrade your health insurance coverage today.