India’s Corporate Giants Add Rs 2.34 Lakh Crore in Value—Reliance Emerges as Biggest Winner

India’s most valuable companies just gained ₹2.34 lakh crore in market capitalisation, with Reliance leading the way. This blog breaks down what that means for investors, mutual funds, and your next financial move.

Nine of India’s ten most valuable companies saw their combined market capitalisation rise by ₹2.34 lakh crore this week, with Reliance Industries leading the surge. This sharp uptick signals renewed investor confidence and highlights the resilience of India’s blue-chip stocks. Here’s why these matters for investors, markets, and the broader economy.

Why a Surge in Market Cap Matters

A jump in market capitalisation among the country’s largest firms is more than just a headline. It reflects strong investor sentiment, robust earnings, and optimism about India’s economic outlook. When heavyweight companies like Reliance, TCS, and HDFC Bank gain value, they drive benchmark indices higher and often set the tone for the broader market.

For retail investors, a surge in large-cap stocks can boost mutual fund NAVs, especially for those holding index or blue-chip funds. It also creates a wealth effect, supporting consumer confidence and spending.

Key Takeaways for Investors

- Reliance Industries Leads the Pack:

Reliance’s strong performance this week contributed the most to the overall market cap gain, reflecting its diversified business model and continued growth in energy, telecom, and retail. - Blue-Chip Stability:

The top-10 firms, spanning sectors like IT, banking, and FMCG, are seen as safe havens during market volatility. Their rising valuations signal market stability and institutional buying. - Mutual Fund Impact:

Many equity mutual funds, especially large-cap and index funds, have significant exposure to these companies. Their gains translate into better portfolio performance for investors. - Behavioral Perspective:

Sharp rallies in top firms can lead to herd behavior, with more investors chasing recent winners. While blue-chips offer stability, it’s important to maintain a diversified portfolio and avoid over-concentration. - Regulatory and Compliance Angle:

Large firms are closely monitored for governance and compliance. Their positive performance often reassures investors about transparency and regulatory adherence in the market. - Fintech and Accessibility:

With digital investment platforms, it’s easier than ever for individuals to participate in market rallies. However, investors should use tools to track risk and avoid impulsive decisions. - Risk and Volatility:

While large-cap surges are positive, sharp corrections can follow periods of rapid gains. Risk management—through asset allocation and periodic review—is crucial.

Real-World Example

Suppose you hold a large-cap mutual fund or ETF. The rally in Reliance and other top firms this week would have pushed up your fund’s NAV, potentially increasing your portfolio’s value without any action on your part. This demonstrates the power of passive investing in quality companies.

What Should Investors Do Next?

- Review Portfolio Exposure:

Check your allocation to large-cap stocks and funds. Ensure it aligns with your risk tolerance and long-term goals. - Don’t Chase Momentum:

Avoid buying solely based on recent rallies. Stick to your investment plan and rebalance if needed. - Stay Informed:

Monitor quarterly results, regulatory updates, and market trends for these key companies. - Use Digital Tools:

Leverage fintech platforms for portfolio tracking, research, and disciplined investing. - Consult Professionals:

For large portfolios or complex holdings, seek advice from financial planners or tax experts.

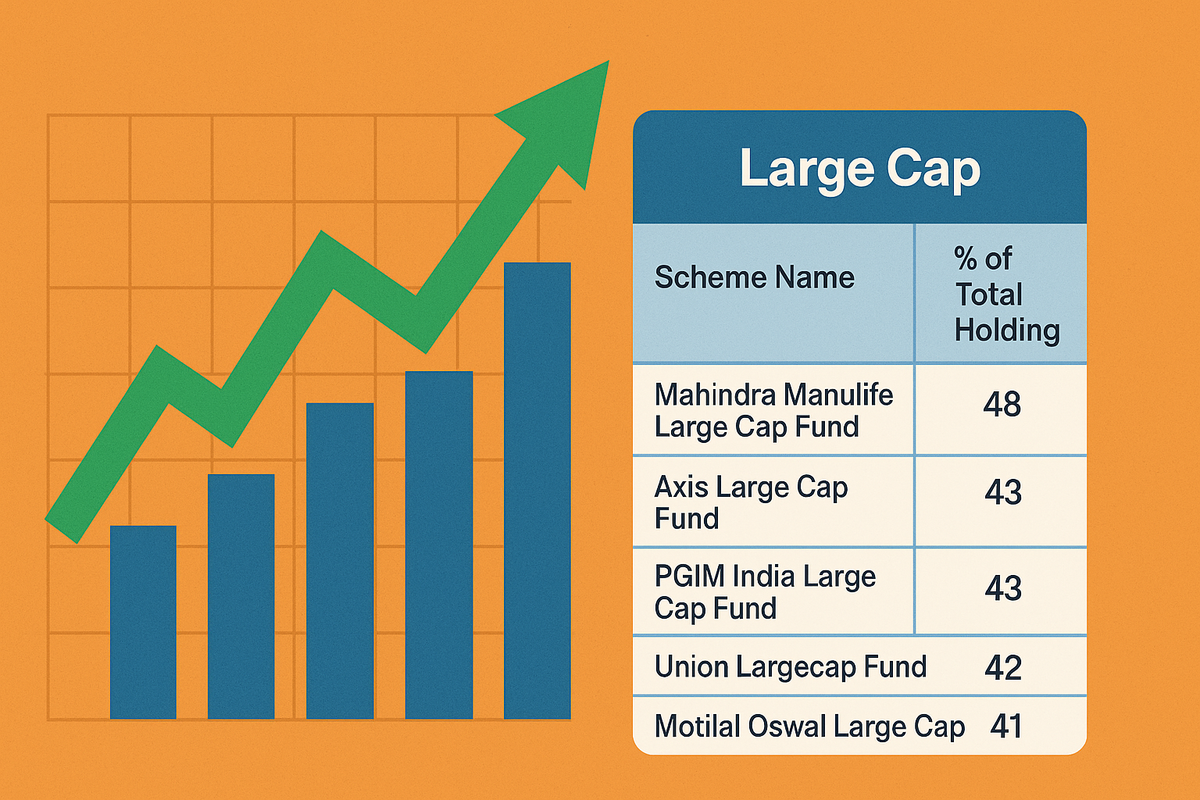

Lookup below mentioned Mutual Fund schemes (Categories – Large Cap, Flexi Cap, Large & Midcap and Multi Cap) where Highest consolidated allocations were taken place within these securities as on 31st May’25.

|

Large Cap |

|

|

Scheme

Name |

% of

Total Holding |

|

Mahindra

Manulife Large Cap Fund |

48 |

|

Axis

Large Cap Fund |

43 |

|

PGIM

India Large Cap Fund |

43 |

|

Union

Largecap Fund |

42 |

|

Motilal

Oswal Large Cap |

41 |

|

Flexi Cap |

|

|

Scheme

Name |

% of Total Holding |

|

Mahindra

Manulife Flexi Cap Fund |

41 |

|

Bandhan

FLEXI CAP FUND |

38 |

|

Sundaram

Flexi Cap Fund |

36 |

|

Axis

Flexi Cap Fund |

34 |

|

SBI

Flexicap Fund |

33 |

|

Large & Mid Cap |

|

|

Scheme

Name |

% of Total Holding |

|

PGIM

India Large and Midcap Fund |

29 |

|

Tata

Large & Mid Cap Fund |

28 |

|

Kotak

Equity Opportunities Fund |

24 |

|

Axis

Large & Mid Cap Fund |

24 |

|

Sundaram

Large and Mid-Cap Fund |

24 |

|

Multi Cap |

|

|

Scheme

Name |

% of Total Holding |

|

ICICI

Prudential Multicap Fund |

23 |

|

Axis

Multicap Fund |

23 |

|

Union

Multicap Fund |

22 |

|

Sundaram

Multi Cap Fund |

21 |

|

Bandhan

MULTI CAP FUND |

20 |

Summary

The surge in market cap among India’s largest firms, led by Reliance Industries, signals strong market sentiment and offers a boost to investors. However, prudent risk management and diversification remain essential. Use this momentum as a reminder to review your portfolio, stay disciplined, and focus on long-term wealth creation.

Disclaimer:

The content provided in these blogs is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy, sell, or hold any mutual fund, scheme, or security. The discussions and analyses are intended solely to foster awareness and understanding of various market situations and financial products. The information presented is based on publicly available data and sources believed to be reliable; however, its accuracy or completeness is not guaranteed.

Readers are expressly advised that they should seek independent professional advice from a qualified financial advisor before making any investment decisions. The author(s) and publisher of these blogs expressly disclaim any liability for any direct or indirect loss or damage of any kind arising out of or in connection with the use of or reliance on any information contained herein. Past performance is not indicative of future results, and all investments are subject to market risks.