JioBlackRock’s Digital-Only Entry: Why Embracing Technology Is Now Survival for Personal Finance Professionals

JioBlackRock’s launch signals a major shift in India’s mutual fund industry. With a digital-first, direct-only approach, it promises lower costs, AI-powered advice, and transparency. Here’s how it’s disrupting traditional distributors and reshaping investor expectations.

India’s mutual fund industry is on the verge of a transformative shakeup as JioBlackRock, a joint venture between Jio Financial Services and BlackRock, prepares to launch with a bold, digital-first, direct-only approach. This new entrant is not just another AMC—it’s a signal that the future of investing in India will be shaped by technology, transparency, and relentless cost efficiency.

Why JioBlackRock’s Entry Is a Game Changer

JioBlackRock brings together Jio’s unparalleled digital reach and BlackRock’s global investment expertise, especially in passive products and ETFs. With $11.58 trillion in assets under management globally, BlackRock’s track record in low-cost, index-based investing is unmatched. Jio, meanwhile, offers access to a vast, tech-savvy customer base, positioning the JV to scale rapidly and democratize investing for millions of Indians.

- Disruption Potential: The partnership is expected to accelerate digitisation, drive down fees, and raise the bar for customer experience across the mutual fund industry.

- Market Impact: Established AMCs are already re-examining their digital strategies, pricing, and investor engagement models to keep pace with the anticipated disruption.

The Direct-Only Model: Why JioBlackRock Is Skipping Distributors

JioBlackRock is launching exclusively with direct plans, bypassing traditional distributor channels entirely. Here’s why this matters:

- Digital-First, AI-Driven Advisory: The future of investing is digital and AI-powered. JioBlackRock’s platform will leverage advanced analytics and BlackRock’s Aladdin platform to deliver fast, transparent, and data-driven advice—tailored to each investor’s needs.

- Lower Costs, Higher Returns: Direct plans eliminate distributor commissions, resulting in a much lower Total Expense Ratio (TER). This cost saving translates directly into higher returns for investors, a benefit that will become increasingly visible as digital platforms highlight these differences in real time.

- Changing Investor Expectations: Today’s investors—especially Gen Z and millennials—demand instant access, data-rich insights, and seamless digital experiences. They are less influenced by traditional relationship-based selling and more by tangible value, transparency, and speed.

- Pressure on Traditional Distributors: Advisors and distributors who do not upgrade their technology, service standards, and advisory capabilities risk becoming obsolete. As pricing and performance data become more transparent, the market will reward those who deliver real value and penalize those who rely solely on legacy relationships.

The Industry’s Response: Adapt or Be Left Behind

JioBlackRock’s arrival is already prompting established players to revisit their digital strategies, pricing models, and customer engagement practices.

- Digitisation and AI: Mutual fund houses are investing in AI-driven advisory, digital onboarding, and data-rich investor journeys to remain competitive.

- Sharper Pricing: As direct plans gain traction, the pressure to lower TERs across the industry will intensify, squeezing margins for both AMCs and distributors.

- Service Standard Revolution: Only those distributors and advisors who adopt superfast, tech-enabled service standards will survive. The days of slow, paper-based processes and opaque advice are numbered.

The Road Ahead: For Investors and Advisors

- For Investors: The rise of direct, digital-first mutual funds means more choice, lower costs, and better access to sophisticated products and global expertise. Investors should embrace platforms that offer transparency, data, and efficiency.

- For Advisors/Distributors: The message is clear—upgrade or risk irrelevance. Embrace technology, deliver real value, and focus on holistic financial planning rather than just product distribution.

The Gen Z and SIP Revolution

With SIP inflows hitting all-time highs and new records being set every month, it’s clear that a new generation of investors is entering the market. These young investors want data, analytics, and instant results—they are not swayed by emotional appeals or legacy relationships. The future belongs to those who can deliver math, speed, and substance

Conclusion

JioBlackRock’s direct-only, digital-first launch is a wake-up call for India’s mutual fund industry. As the future shifts toward AI-powered advice, low-cost products, and instant digital service, the winners will be those who adapt quickly and deliver what the new generation of investors truly wants: data, speed, and results—not just relationships or tradition.

How will the shift to low-cost, high-return direct schemes impact traditional distributors and advisors

The shift towards low-cost, high-return direct mutual fund schemes is profoundly impacting traditional distributors and advisors in India’s investment landscape. Here’s how this transition is reshaping their roles and business models:

1. Erosion of Commission-Based Income

Traditional distributors earn commissions ranging from 0.1% to 2% on regular mutual fund plans, which are embedded in the expense ratio and reduce investor returns. Direct plans, by eliminating intermediaries, have significantly lower expense ratios, resulting in higher returns for investors. Over long investment horizons, this difference compounds, making direct plans increasingly attractive and reducing the appeal of regular plans sold through distributors.

2. Pressure to Upgrade Technology and Service Standards

As investors—especially younger and digitally savvy ones—gravitate towards direct plans accessed via online platforms, distributors face pressure to modernize. Those who fail to adopt advanced technology, AI-driven advisory tools, and provide faster, more transparent service risk losing relevance. The market is rewarding advisors who can offer data-driven, personalized advice efficiently, while those relying solely on traditional relationship-based selling face obsolescence.

3. Changing Investor Expectations

The new generation of investors, including millennials and Gen Z, demand instant access to information, data-backed insights, and seamless digital experiences. Emotional or relationship-based selling is no longer sufficient. Investors want transparency, control, and speed, which direct plans and digital platforms provide. Distributors who cannot meet these expectations risk losing clients to direct digital channels16.

4. Shift from Product Selling to Advisory Role

With direct plans bypassing distributors, many traditional intermediaries are pivoting towards fee-based advisory models, focusing on holistic financial planning rather than just product distribution. This transition requires building trust through value-added services, financial education, and personalized guidance, rather than relying on commissions from product sales.

5. Institutional and Corporate Shift to Direct Plans

Large institutions and corporate treasuries are increasingly investing directly in mutual funds to reduce costs, bypassing distributors. This trend has led to scaling down of institutional distribution businesses and a shift towards advisory services where clients pay for advice rather than product commissions. Distributors servicing institutional clients face significant challenges and are adapting by offering consultancy and operational support.

6. Consolidation and Specialization in Distribution

The retail distribution landscape is undergoing consolidation, with scale players and niche specialists emerging. Distributors are focusing on areas like long-term savings solutions and discretionary portfolio management to justify advisory fees. Success increasingly depends on leveraging technology, improving asset allocation capabilities, and offering differentiated services.

Summary

The rise of direct mutual fund plans with lower expense ratios and higher returns is disrupting traditional distribution channels. Distributors and advisors must embrace technology, enhance service standards, and transition towards advisory roles to remain relevant. Those who fail to adapt risk losing market share as investors increasingly prefer transparent, cost-effective, and digitally accessible investment options.

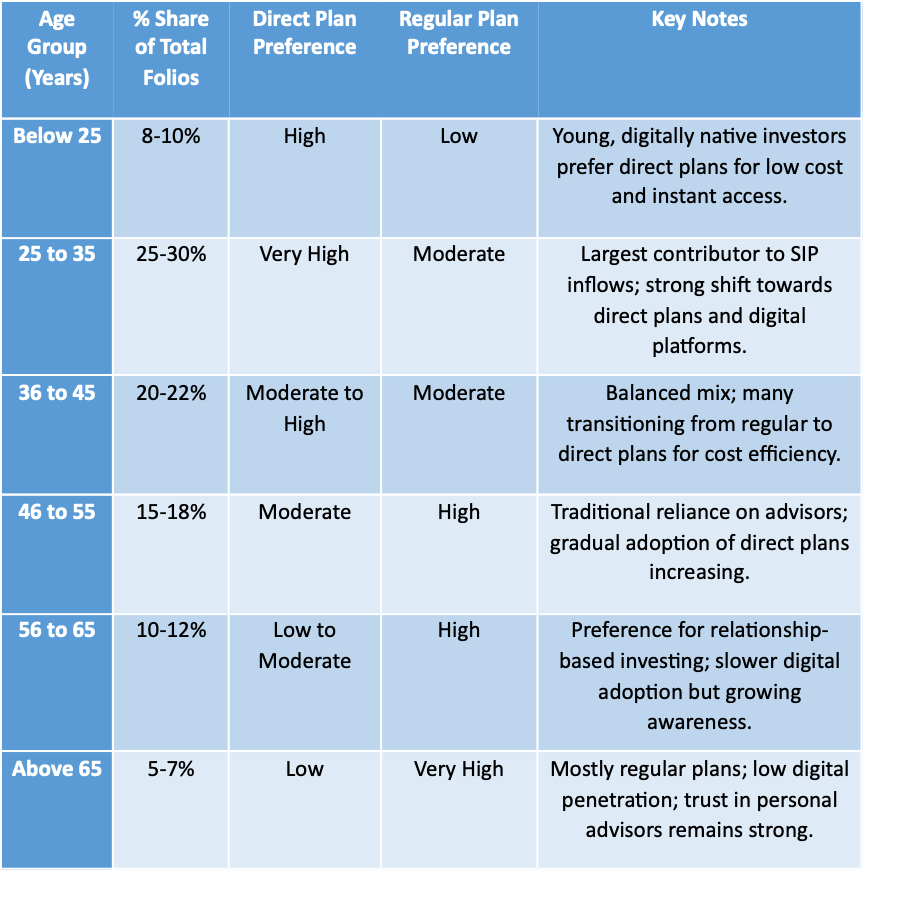

Visualisation Summary:

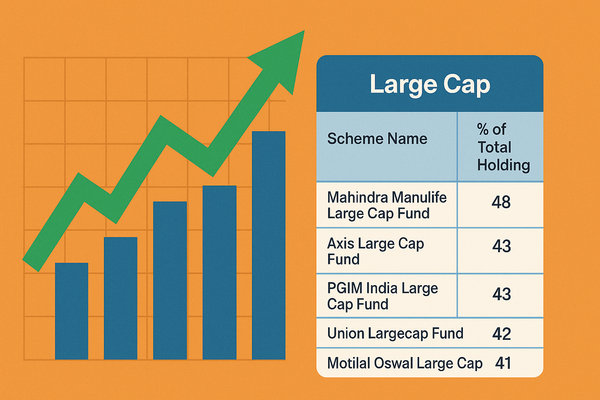

- Younger investors (Below 35) dominate direct plan folios, driven by digital adoption, cost sensitivity, and preference for self-directed investing.

- Middle-aged investors (36-55) represent a transitional group balancing between direct and regular plans.

- Senior investors (56+) predominantly hold regular plans but are slowly exploring digital options.

*Note: Exact data on Direct vs Regular folio split by age is not publicly detailed by AMFI, but industry trends and surveys indicate younger investors prefer Direct plans, while older investors rely more on distributors.

Key Insights

- Young Investors (Below 35 years):

This group is driving the surge in Direct mutual fund folios, leveraging digital platforms for investing. They prioritize low expense ratios, transparency, and instant access to data. SIP inflows from this segment are at record highs, reflecting disciplined, long-term investing habits. - Middle-Aged Investors (36-55 years):

This cohort is in transition, with many still using traditional advisors but increasingly exploring Direct plans to reduce costs. Hybrid approaches—using both advisors and digital platforms—are common. - Senior Investors (Above 55 years):

Tend to prefer Regular plans through trusted distributors due to comfort with personal relationships and lower digital adoption. However, awareness and adoption of digital channels are gradually growing.

Industry Data Highlights

- Total mutual fund folios in India crossed 23.6 crore (236 million) as of April 2025, with equity, hybrid, and solution-oriented schemes accounting for about 18.7 crore folios.

- The retail investor segment dominates equity schemes, contributing about 88% of AUM.

- Passive fund folios have seen a 16x growth in five years, with younger investors driving this trend.

- SIP inflows hit record levels in FY25, with new SIP accounts predominantly opened by investors aged 25-35.