Why True International Asset Allocation Matters More Than Just Thematic Funds

Don’t confuse thematic funds with true global diversification. A well-structured international allocation spreads risk, captures worldwide growth, and cushions your portfolio. Here’s why it matters—and what to do about it.

Why It’s Important to See International Asset Allocation Within Your Portfolio—Beyond Thematic International Schemes

International asset allocation is more than just adding a few global-themed funds to your portfolio. True global diversification can protect your wealth, unlock new growth, and reduce risks that may not be visible when you only invest in domestic or thematic international schemes. Here’s why this matters and what you should do.

The Core Message: Diversification Goes Beyond Borders

Limiting your international exposure to thematic schemes—like technology or healthcare funds—means you’re only scratching the surface of global diversification. These funds often focus on a single sector or region, which can leave your portfolio exposed to concentrated risks and miss out on broader opportunities.

Why Broader International Allocation Matters

- Reduces Home Country Risk:

Relying only on Indian markets or a single foreign theme ties your wealth to the fate of one economy or sector. Broader global allocation spreads your risk across countries and industries. - Captures Global Growth:

Many of the world’s leading businesses and innovations are outside India. Allocating to international markets gives you access to global leaders in sectors like technology, consumer goods, and healthcare. - Smooths Portfolio Volatility:

Markets don’t move in sync. When Indian equities underperform, global markets—like the US, Europe, or emerging Asia—may do well, helping to stabilize your overall returns. - Protects Against Currency Fluctuations:

Investing internationally can act as a hedge if the rupee weakens, preserving your purchasing power for future global needs—like travel, education, or overseas expenses. - Avoids Overlap and Concentration:

Thematic international funds may overlap in holdings or focus too narrowly. Broader international funds or ETFs offer more balanced exposure across sectors and geographies.

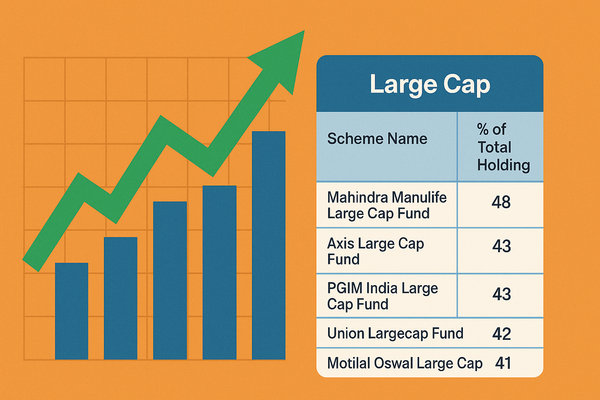

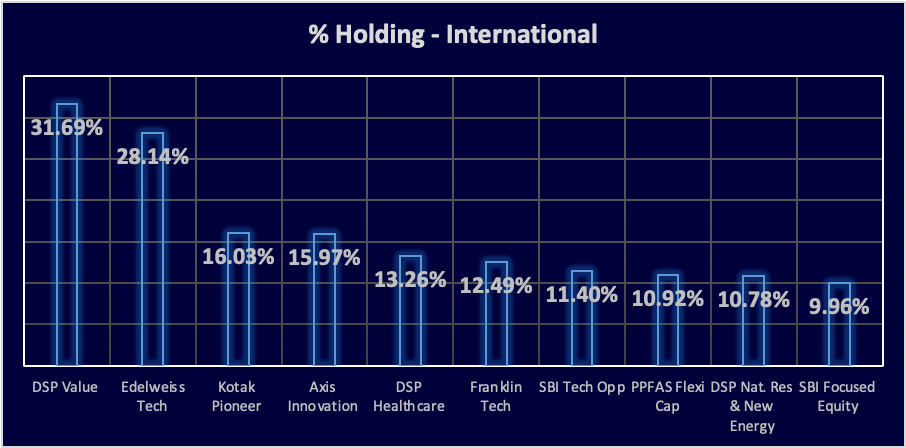

Indian Mutual Fund Schemes where good exposures were taken in international stocks (International Thematic schemes not considered)

Actionable Takeaways for Investors

- Review Your Portfolio’s True Global Exposure:

Don’t just count thematic funds. Check if you have diversified international equity, debt, or multi-asset funds. - Aim for Balanced Allocation:

Consider allocating 10-20% of your equity portfolio to diversified international funds, not just sectoral or country-specific themes. - Understand Tax and Regulatory Implications:

International investments have different tax rules and reporting requirements. Stay compliant and plan for tax efficiency. - Use Digital Tools and Fintech Platforms:

Leverage platforms that offer global funds, ETFs, and research to make informed choices and track performance. - Avoid Chasing Recent Winners:

Don’t over-allocate to a hot sector or country based on recent returns. Diversification is about balance, not bets. - Consult a Professional for Complex Needs:

If you have significant global assets or income, a financial advisor or tax expert can help you optimize allocation and compliance.

Real-World Example

If you only invest in a US tech fund, your portfolio rises and falls with the fortunes of a single sector and country. But if you add a global equity fund, you get exposure to Europe, Japan, emerging markets, and various industries. This cushions your portfolio against shocks in any one market or sector.

Summary and Next Steps

International asset allocation is a key pillar of modern investing. Don’t limit your global exposure to thematic or sectoral funds. Instead, aim for broad, balanced international diversification to manage risk, capture growth, and build a resilient portfolio. Review your holdings, rebalance as needed, and seek professional guidance for complex needs.

Disclaimer:

The content provided in these blogs is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy, sell, or hold any mutual fund, scheme, or security. The discussions and analyses are intended solely to foster awareness and understanding of various market situations and financial products. The information presented is based on publicly available data and sources believed to be reliable; however, its accuracy or completeness is not guaranteed.

Readers are expressly advised that they should seek independent professional advice from a qualified financial advisor before making any investment decisions. The author(s) and publisher of these blogs expressly disclaim any liability for any direct or indirect loss or damage of any kind arising out of or in connection with the use of or reliance on any information contained herein. Past performance is not indicative of future results, and all investments are subject to market risks.