India’s Mobile Internet Boom: Small Cap Stocks Set to Ride the Next Digital Surge

India's mobile-first internet boom is reshaping the digital economy—see why small cap stocks are key to this transformation in 2025.

India’s digital revolution in 2025 is being powered by mobile internet, which now accounts for the vast majority of the country’s online traffic. This dominance is not only transforming daily life and commerce but is also creating a fertile ground for the next generation of high-growth companies—especially in the small cap segment. For investors seeking the future stars of India’s digital economy, understanding the drivers behind this trend and identifying promising small cap stocks is crucial.

Why Mobile Internet Dominates India’s Digital Traffic

India’s mobile internet dominance is the result of several converging trends:

- Explosive User Growth: India is on track to surpass 900 million internet users in 2025, with more than half coming from rural areas—a demographic that overwhelmingly accesses the web via mobile devices. The internet penetration rate has jumped from just 14% in 2014 to over 55% in 2025, making India the world’s second-largest online market.

- Smartphone and Mobile Penetration: Over 97% of Indians aged 15–29 use mobile phones, and in rural areas, 92.7% of young people have accessed the internet in the past three months. Affordable smartphones and cheap data plans—thanks to fierce telecom competition—have made internet access nearly universal.

- Superior Mobile Network Infrastructure: Median mobile internet speeds reached 100.78 Mbps in early 2025, outpacing fixed broadband (63.55 Mbps). The rapid expansion of 4G and 5G networks, with 5G subscriptions set to account for 30% of all mobile internet by year-end, ensures high-speed connectivity even in remote areas.

- Content and Usage Patterns: Indians spend an average of 90 minutes online daily, with OTT video/audio streaming, social media, and digital payments among the top activities. Regional language (Indic) content now dominates, making digital platforms accessible to a broader audience.

- Low Fixed Broadband Penetration: With only 4% of households having fixed broadband, smartphones are the primary gateway to the internet for most Indians.

- Rural Surge and Digital Inclusion: Rural areas are outpacing urban regions in new internet user growth, boasting 488 million active users compared to 397 million in urban India. Government initiatives like BharatNet and Digital India have accelerated rural connectivity.

The Market Opportunity: Small Cap Stocks for the Digital Future

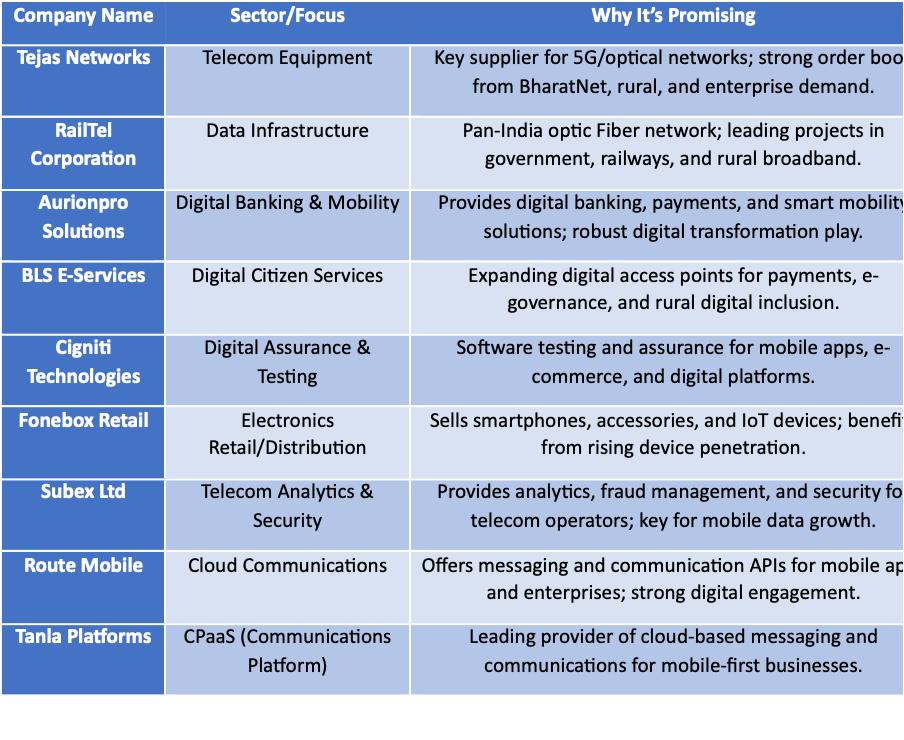

As India’s mobile internet usage continues to surge, several small cap companies are strategically positioned to benefit from this digital wave. Here are some notable names and why they stand out:

Why These Small Caps Stand Out

- Tejas Networks and RailTel Corporation are building the backbone of India’s digital infrastructure, supplying equipment and connectivity to power 4G/5G and rural broadband expansion.

- Aurionpro Solutions and BLS E-Services are enabling the digital transformation of banking, payments, and citizen services, especially in semi-urban and rural India.

- Cigniti Technologies, Subex Ltd, Route Mobile, and Tanla Platforms are critical enablers of secure, scalable, and reliable digital services—ranging from app testing to cloud communications and telecom analytics.

- Fonebox Retail is capitalizing on the surge in affordable smartphone adoption and device upgrades, especially in Tier 2/3 cities and rural areas.

Key Data Points for Investors

- Mobile Internet Penetration: Expected to reach 81.4% by end-2025, up from 47.3% in 2020.

- Data Consumption: Average monthly mobile data usage per user is forecast to rise from 9.2 GB (2020) to 25 GB (2025).

- Market Size: Mobile data services revenue is projected to double from $6.3 billion (2020) to $12.5 billion (2025), a CAGR of 14.7%.

- Rural Growth: 55% of internet users are now from rural India, with rural user growth outpacing urban since 2021.

Strategic Perspective for Investors

- Short-Term:

Investors can look for tactical opportunities as government projects, 5G rollout, and rural connectivity schemes drive order flows and revenue growth for these small caps. Quarterly results, order book updates, and new contract wins are key signals. - Long-Term:

As India’s mobile internet penetration deepens and digital services become more embedded in daily life, these companies could see multi-year compounding growth. SIPs in small-cap or digital-focused mutual funds with exposure to these names can help manage volatility while capturing upside.

Conclusion

India’s mobile internet dominance is not just a technological phenomenon—it’s a massive investment opportunity. As the country’s digital infrastructure expands and more citizens come online, small cap companies building, enabling, or servicing the mobile-first ecosystem are poised for significant growth. For investors with a long-term view and appetite for higher risk, these emerging leaders could be the next big winners in India’s digital story.

Disclaimer:

The stocks mentioned above are for informational purposes only and not investment advice. Small cap stocks can be highly volatile and risky. Please conduct your own research or consult a financial advisor before making investment decisions.