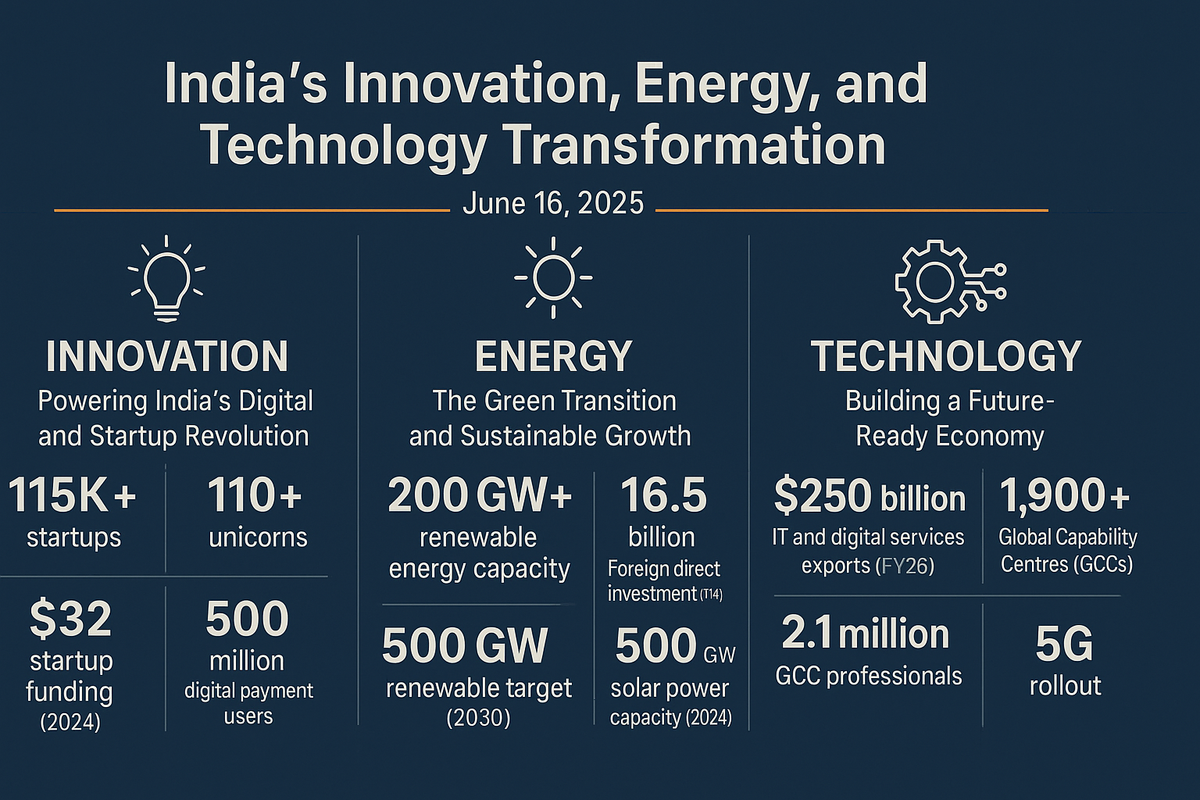

Sectors Like Innovation, Energy, Technology Offer Immense Potential: Aligning with India’s Reform Trajectory

India is entering a new growth phase led by innovation, clean energy, and digital transformation. Backed by policy reforms and global capital, these sectors are opening long-term opportunities for investors and wealth planners. Here’s how to position your portfolio in 2025 and beyond.

On June 16, 2025, India’s leadership spotlighted the immense potential of innovation, energy, and technology sectors during a high-profile meeting with CEOs in Cyprus. This vision, rooted in a decade of reforms and global engagement, is fundamentally transforming India’s economic and investment landscape—and opening new avenues for investors and wealth planners.

Innovation: Powering India’s Digital and Startup Revolution

India’s innovation ecosystem is experiencing unprecedented momentum, positioning the country as a global leader in digital transformation and entrepreneurship. As of 2025, India is home to more than 115,000 startups and over 110 unicorns, making it the world’s third-largest startup hub. Government initiatives like “Digital India” and “Startup India” have played a pivotal role in nurturing this environment, resulting in a record $32 billion in startup funding in 2024—an 18% jump from the previous year. Digital payments have become mainstream, with over 500 million users, and internet access now reaches 900 million citizens. This surge in innovation is not only creating jobs and attracting global investors but also positioning India at the forefront of the digital economy.

Energy: The Green Transition and Sustainable Growth

India’s energy sector is undergoing a historic transformation, closely aligned with the nation’s vision for sustainable development and global leadership in renewables. By 2025, India’s installed renewable energy capacity surpassed 200 GW, with an ambitious target of 500 GW by 2030. The sector attracted $16.5 billion in foreign direct investment in FY24, as major conglomerates like Reliance, Adani, and Tata Power committed over ₹2 lakh crore to green energy projects. Government policies such as 100% FDI in renewables, production-linked incentives, and the National Green Hydrogen Mission are accelerating this shift. Solar power alone has grown from 2.5 GW in 2014 to over 94 GW in 2024, and wind energy capacity has more than doubled since 2014. These investments are helping India meet its climate goals, reduce dependence on fossil fuels, and create new opportunities in solar, wind, and green hydrogen.

Technology: Building a Future-Ready Economy

Technology is at the heart of India’s reform-driven growth, driving productivity, competitiveness, and new business models. The IT and digital services sector is projected to reach $250 billion in exports by FY25, up from $194 billion in FY23. The rapid rollout of 5G, widespread adoption of artificial intelligence, and the rise of Global Capability Centres (GCCs) have made India a global technology powerhouse. More than 1,900 GCCs now employ 2.1 million professionals and contribute $46 billion in annual value. These advancements are expanding market access, enabling digital public infrastructure, and positioning India as a leader in the global digital economy.

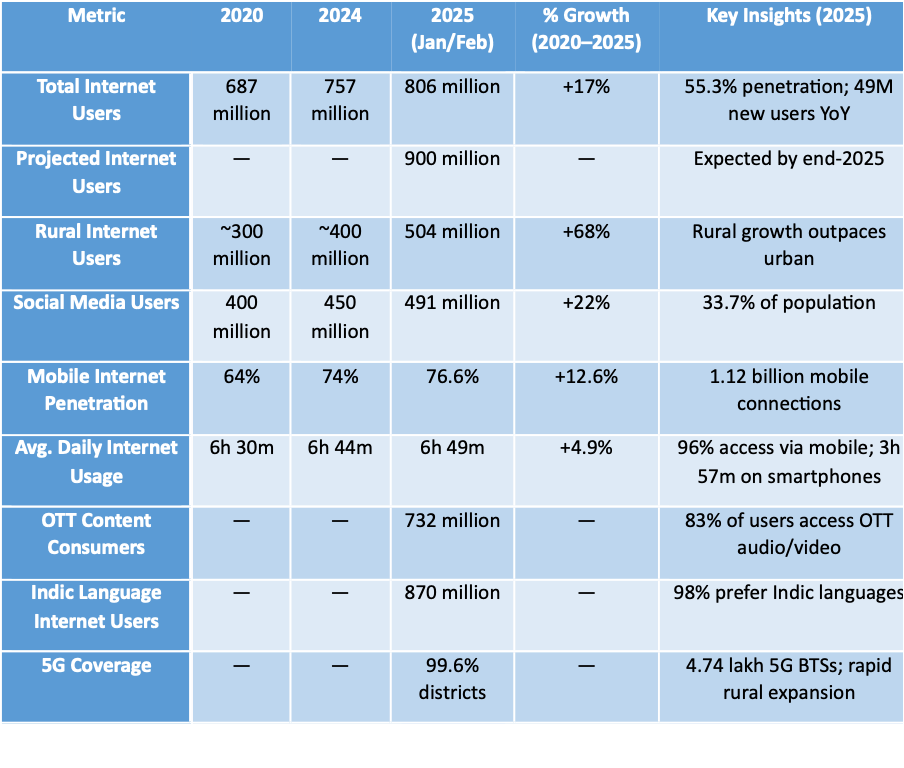

Digital Platform Usage Growth in India (2020–2025)

Key Trends & Insights

- Rural Surge: Rural India is driving growth, expected to reach 504 million rural internet users by 2025—outpacing urban expansion.

- Mobile-First Nation: 96% of users access the internet via mobile, making India one of the largest mobile-first digital communities globally.

- Social Media Boom: Social media identities reached 491 million in early 2025, up 22% in five years, with over half of all internet users active on social platforms.

- Affordability & Access: Data costs have fallen from ₹308/GB (2014) to under ₹10/GB, and BharatNet has connected over 2.18 lakh villages with high-speed internet.

- Content Shift: 83% of internet users consume OTT content; 98% of users access the web in Indic languages, underlining the vernacular and video boom.

- 5G & Infrastructure: 5G now covers 99.6% of districts, supporting a 1.12 billion-strong mobile subscriber base and deeper digital engagement.

How Investors and Wealth Planners Can Capitalize

Short-Term Strategies

- Tactical Allocation to Sector Leaders: Investors can increase exposure to listed companies leading in renewables, technology, and innovation—such as those in Nifty IT, top energy stocks, and digital-first businesses—using direct equity or sectoral/thematic mutual funds.

- Participate in IPOs and New Listings: The ongoing wave of tech and green energy IPOs offers opportunities for early entry into high-growth businesses.

- Monitor Policy Announcements: Stay agile to government reforms, incentive schemes, and global partnerships that can trigger short-term rallies in these sectors.

Long-Term Strategies

- Core Portfolio Exposure: Wealth planners should consider making innovation, energy, and technology a core part of client portfolios, given their structural growth trends and alignment with India’s economic priorities.

- Diversified Mutual Funds and ETFs: For long-term wealth creation, diversified funds with significant allocations to these sectors can help investors ride multi-year growth cycles while managing volatility.

- SIP Approach: Systematic Investment Plans (SIPs) in sectoral or diversified funds allow investors to benefit from rupee cost averaging, compounding, and resilience during market corrections.

- Sustainable and ESG Investing: Given the policy push towards sustainability, integrating ESG (Environmental, Social, Governance) funds and green bonds into portfolios can capture both growth and risk management benefits, especially as global capital increasingly flows to sustainable assets.

Strategic Perspective

India’s reform-driven push in innovation, energy, and technology is not just about capitalizing on current trends—it’s about building resilience and future-proofing portfolios. These sectors are expected to drive job creation, global competitiveness, and sustainable development for decades. For investors and wealth planners, the key is to blend tactical opportunities (short-term sector momentum, IPOs, and policy-driven moves) with strategic, long-term allocation to these transformative themes.

Risks and Considerations

While the long-term outlook is robust, investors must remain cautious of short-term risks:

- High Valuations: Technology and energy stocks often trade at premium valuations, making them sensitive to earnings disappointments and global corrections.

- Policy and Execution Risks: Delays in reforms, regulatory changes, or project execution can introduce volatility.

- Global Headwinds: Economic slowdowns, rising rates, or supply chain disruptions can impact sectoral performance.

- Sector Rotation: During market corrections, high-growth sectors may see sharper pullbacks.

Prudent diversification, regular portfolio reviews, and a disciplined investment approach are essential to navigate these risks.

Conclusion

India’s economic future is being shaped by relentless innovation, a green energy revolution, and technological leadership—sectors now at the heart of the country’s growth strategy. By aligning investment and wealth planning strategies with these themes, investors can participate in India’s next growth wave while remaining mindful of the risks that come with rapid transformation. The opportunity is immense for those who act with vision, discipline, and a long-term perspective.

Disclaimer:

The content provided in these blogs is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy, sell, or hold any mutual fund, scheme, or security. The discussions and analyses are intended solely to foster awareness and understanding of various market situations and financial products. The information presented is based on publicly available data and sources believed to be reliable; however, its accuracy or completeness is not guaranteed.

Readers are expressly advised that they should seek independent professional advice from a qualified financial advisor before making any investment decisions. The author(s) and publisher of these blogs expressly disclaim any liability for any direct or indirect loss or damage of any kind arising out of or in connection with the use of or reliance on any information contained herein. Past performance is not indicative of future results, and all investments are subject to market risks.