Gold Mania 2025: Why Every Indian Portfolio Needs a Golden Touch Amid Global Uncertainty, What Every Indian Investor Should Know in 2025

In 2025, gold is rising fast. Here's why Indian investors are adding it to their portfolios for safety and growth.

Rising geopolitical tensions and the global shift away from the US dollar are fuelling an unprecedented surge in gold demand worldwide. As trade wars escalate and central banks diversify their reserves, gold’s allure as a safe-haven asset has never been stronger. Yet, with supply growth lagging behind, the stage is set for continued price momentum, impacting everything from global portfolios to the Indian mutual fund landscape.

Central banks are leading the charge, with gold purchases surpassing 1,000 tonnes for the third consecutive year. India’s Reserve Bank has been a major participant, adding over 72 tonnes in 2024 alone and bringing its total gold reserves to 876.18 tonnes—making India the seventh-largest gold holder globally and the second-largest buyer last year1. This accumulation is not just a matter of tradition; it’s a strategic response to global uncertainty and the need for portfolio resilience.

Here’s how the world’s top 10 gold reserves stack up as of early 2025:

|

Rank |

Country |

Gold Reserves (Tonnes) |

|

1 |

United States |

8,133.46 |

|

2 |

Germany |

3,351.53 |

|

3 |

Italy |

2,451.84 |

|

4 |

France |

2,437.00 |

|

5 |

China |

2,279.56 |

|

6 |

Switzerland |

1,039.94 |

|

7 |

India |

876.18 |

|

8 |

Japan |

845.97 |

|

9 |

Netherlands |

612.45 |

|

10 |

Poland |

448.23 |

The surge in demand comes at a time when gold supply remains constrained, growing just 1% year-on-year in early 2025. This imbalance has pushed global gold prices to record highs, with international rates crossing $3,400 per ounce. In India, gold prices have mirrored this rally, breaching the ₹1 lakh mark per 10 grams for the first time in history1. Over the past year, domestic gold prices have soared by 50%, and they have doubled in less than three years.

What does this mean for Indian investors and the mutual fund industry?

The Indian stock market has seen a noticeable shift as investors seek the safety of gold amid equity volatility. Gold ETFs and gold-focused mutual funds have witnessed a dramatic uptick in inflows, with domestic demand for bars and coins rising nearly 30% year-on-year. Mutual fund houses are actively promoting gold as a portfolio diversifier, and advisors are recommending strategic allocations to gold funds to hedge against global shocks and currency risks.

Speculation for the Next Five Years

Looking ahead, the outlook for gold remains bullish. With ongoing trade disputes, persistent inflation, and the global push for de-dollarisation, analysts expect gold prices in India to maintain their upward trajectory. Many forecasts suggest that, barring a dramatic reversal in global risk sentiment or a sudden surge in supply, gold could see another 30–50% appreciation over the next five years. This could push domestic prices toward ₹1.3–1.5 lakh per 10 grams by 2030, especially if the rupee weakens further or global uncertainties persist1.

In summary, the combination of rising global demand, limited supply, and macroeconomic uncertainty is making gold an increasingly vital asset for Indian investors. The mutual fund industry is responding with innovative gold-linked products, and savvy investors are taking note. In these unpredictable times, gold’s shine is more than tradition—it’s a strategic necessity.

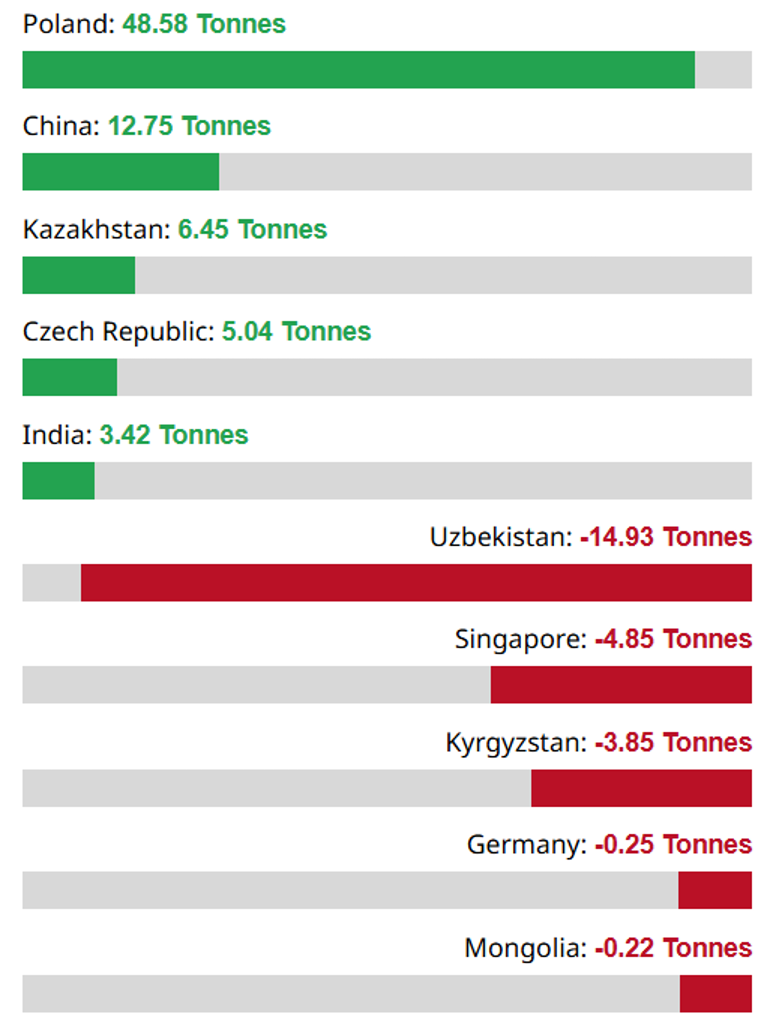

Largest increases / decreases

Note: Current account and gross domestic product data is lagged by a quarter due to data availability (last update 2024-09-30).

RBI’s Strategic Diversification of Reserves

The Reserve Bank of India continues to steadily increase its gold holdings as part of a broader strategy to diversify its foreign exchange reserves. By reducing reliance on the US dollar and other currencies, the RBI aims to enhance the safety and stability of India’s overall reserve portfolio. This diversification is likely to remain a key driver of gold reserve growth in the coming years.

Impact of Global Economic and Geopolitical Uncertainty

Ongoing trade wars, shifting geopolitical alliances, and unpredictable monetary policies by major economies are pushing central banks—including India’s—to accumulate more gold. Gold’s reputation as a safe-haven asset during times of uncertainty makes it an appealing choice for reserve managers looking to hedge against currency volatility and inflation.

Influence of Gold Price Movements

The value of India’s gold reserves is directly affected by changes in global gold prices. Even if the quantity of gold held remains the same, rising prices can significantly boost the overall value of reserves. With many analysts forecasting continued price appreciation, this factor will likely play a major role in reserve growth.

Domestic Policy and Import Regulation Dynamics

Government policies such as import duties, the Gold Monetization Scheme, and Sovereign Gold Bonds impact both the import and mobilization of gold within India. Recent policy adjustments, including lower import duties and increased mobilization of household gold, support reserve growth while helping to manage the country’s current account deficit.

Rise of Digital and Financial Gold Products

Innovations like gold ETFs, digital gold accounts, and blockchain-based platforms are making gold investments more accessible and transparent. The RBI’s interest in these digital products could encourage both private and official gold accumulation, further strengthening reserves.

Seasonal and Cultural Demand Patterns

India’s deep-rooted cultural affinity for gold, especially during festivals and weddings, drives significant seasonal demand. This ongoing demand influences import patterns and can indirectly affect the RBI’s reserve management strategies.

International Trade and Repatriation Strategies

Efforts to repatriate gold stored overseas and optimize storage logistics are also shaping India’s gold reserve strategy. Changes in global trade policies and new international collaborations could further impact how and where India holds its gold reserves.

Global Central Bank Trends

India is part of a larger global movement among central banks to increase gold reserves. As more countries diversify away from the US dollar and seek protection against global shocks, the RBI’s actions are likely to align with these international trends, supporting continued accumulation.

India’s gold mutual fund landscape is thriving as investors seek safer, more liquid ways to benefit from the ongoing global gold rush. Several leading gold mutual funds and ETFs have capitalized on this demand surge, structuring their portfolios to closely track gold prices and offer investors a seamless, cost-effective alternative to physical gold.

Here’s a comparative chart of top gold mutual fund schemes in India, including recent performance data (as of mid-2025):

|

Fund Name |

AUM (₹ Cr) |

Expense Ratio (%) |

1Y Return (%) |

3Y CAGR (%) |

5Y CAGR (%) |

|

SBI Gold Fund |

3,931 |

0.10 |

31.80 |

22.39 |

14.03 |

|

ICICI Prudential Regular Gold

Savings Fund |

2,057 |

0.09 |

31.00 |

22.00 |

13.82 |

|

Axis Gold Fund |

1,033 |

0.17 |

31.00 |

22.00 |

14.07 |

|

Kotak Gold Fund |

3,028 |

0.16 |

31.00 |

22.00 |

13.9 |

|

HDFC Gold ETF Fund of Fund |

3,558 |

0.18 |

31.00 |

22.00 |

13.9 |

|

Nippon India Gold Savings Fund |

2,959 |

0.13 |

31.00 |

19.52 |

13.76 |

|

Aditya Birla SL Gold Fund |

601 |

0.20 |

31.00 |

22.00 |

14.11 |

|

Invesco India Gold ETF FoF |

155 |

0.10 |

31.00 |

22.00 |

13.91 |

|

Quantum Gold Saving Fund |

192 |

0.03 |

31.00 |

22.00 |

13.89 |

|

LIC MF Gold ETF FoF |

125 |

0.20 |

31.00 |

22.00 |

13.77 |

Category average for 1Y and 3Y returns is around 31% and 22% respectively, as most gold funds closely track the price of gold

Note:

- Data as of May–June 2025.

- Returns are annualized for 3Y and 5Y periods.

- Actual 1Y and 3Y returns for some funds may vary slightly but are generally in line with the category due to the direct linkage with gold prices.

Gold mutual funds have delivered robust returns in the recent past, significantly outperforming many equity categories, and remain highly liquid compared to physical gold

How Fund Houses Are Leveraging the Gold Opportunity

These funds primarily invest in gold ETFs or directly in physical gold (held in secure vaults), ensuring their portfolios mirror the price movement of gold with minimal tracking error. For example, the ICICI Prudential Regular Gold Savings Fund invests in the ICICI Prudential Gold ETF, while the Axis and Kotak Gold Funds invest in their respective gold ETFs. This structure allows fund managers to efficiently manage inflows and outflows, rebalance portfolios, and maintain high liquidity.

Fund houses are also focusing on cost efficiency and transparency. Gold ETFs like Nippon India ETF Gold BeES, SBI Gold ETF, and HDFC Gold ETF are among the largest and most liquid in the market, with assets under management running into thousands of crores. They are traded on stock exchanges, providing real-time pricing and ease of buying or selling units at market value67. This approach ensures that investors can enter or exit their gold positions quickly, without the hassles associated with physical gold.

Liquidity Advantage over Physical Gold

One of the biggest advantages of gold mutual funds and ETFs is their superior liquidity. Unlike physical gold, which can involve making charges, purity concerns, and delays in selling, gold ETFs and mutual funds can be bought or sold instantly on stock exchanges or through fund platforms. There are no worries about storage, insurance, or security. Additionally, the absence of a lock-in period means investors have the flexibility to react to market movements or personal financial needs without penalty

Why These Funds Stand Out

- Portfolio Alignment: Fund managers actively monitor global gold trends and rebalance portfolios to ensure returns closely track gold prices.

- Transparency: Daily NAV disclosures and real-time trading make it easy for investors to track performance.

- Cost-Effectiveness: Lower expense ratios compared to the costs of buying, storing, and insuring physical gold.

- Accessibility: Investors can start with small amounts, making gold investment inclusive and convenient.

Conclusion

With global gold demand surging due to trade wars, de-dollarisation, and supply constraints, India’s top gold mutual funds and ETFs offer a smart, liquid, and efficient way to participate in gold’s rally. As fund houses continue to innovate and optimize their portfolios, these products are set to remain a preferred choice for investors seeking both safety and growth in uncertain times

Disclaimer:

The content provided in these blogs is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy, sell, or hold any mutual fund, scheme, or security. The discussions and analyses are intended solely to foster awareness and understanding of various market situations and financial products. The information presented is based on publicly available data and sources believed to be reliable; however, its accuracy or completeness is not guaranteed.

Readers are expressly advised that they should seek independent professional advice from a qualified financial advisor before making any investment decisions. The author(s) and publisher of these blogs expressly disclaim any liability for any direct or indirect loss or damage of any kind arising out of or in connection with the use of or reliance on any information contained herein. Past performance is not indicative of future results, and all investments are subject to market risks.