Copper’s Wealth Wave: How the Red Metal Could Power 30%+ Portfolio Growth by 2030—A Game Changer for Indian Investors, Advisors, and Newcomers Alike

Copper is making headlines in 2025 with a sharp rise in prices fueled by clean energy demand, infrastructure push, and supply gaps. Find out how it impacts Indian mutual funds and how you can invest.

Copper is capturing global headlines in 2025, thanks to surging demand from green technologies, electrification, and infrastructure growth. The red metal’s price momentum, supply challenges, and its rising status in Indian mutual fund portfolios make it a compelling story for both institutional and retail investors. Here’s a deep dive into copper’s market dynamics, its impact on Indian mutual funds, and how you can participate in this growth wave.

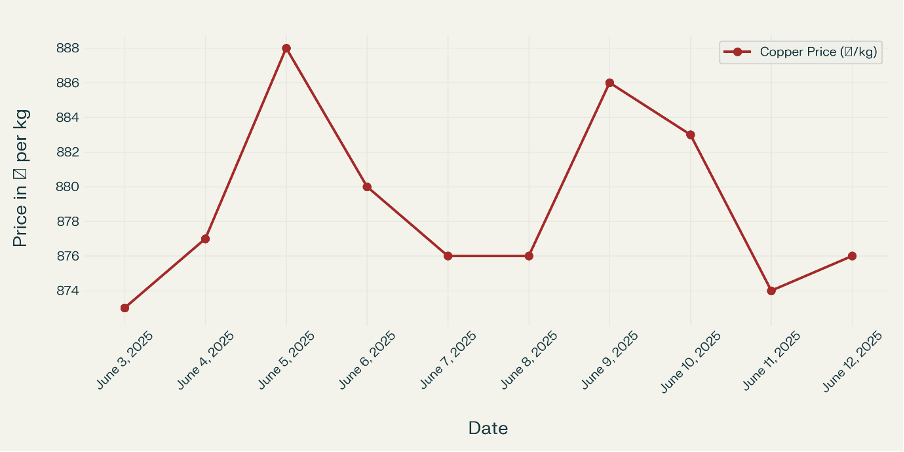

Copper Price Trends 2025: Global and Indian Markets

- MCX Copper Price (India):

- June 12, 2025: ₹876 per kg

- 52-week high: ₹883 | 52-week low: ₹633

- Recent movement: Prices have climbed from ₹812.55 in January 2025, reflecting strong demand and tight supply.

- Global Copper Price:

- LME Cash Price (June 12, 2025): $4.81/lb (approx. $9,849/tonne).

- Monthly trend: Up 3.09% in the past month and 7.44% year-to-date.

What’s Driving the Copper Boom?

1. Explosive Demand from Clean Energy & Electrification

Copper is critical for solar panels, wind turbines, EV batteries, and charging infrastructure. India’s focus on renewable energy and electrification is pushing demand to new highs, with domestic copper demand projected to grow 7% annually over the next few years.

2. Supply Constraints and Investment in Mining

Mine closures, declining ore grades, and limited new supply are keeping copper markets tight. Major Indian players like Hindustan Copper are investing ₹2,000 crore to triple mining capacity by 2030, and partnering with global giants like CODELCO to secure future supply.

3. Industrial and Infrastructure Growth

Copper’s use in construction, electronics, and transportation underpins its long-term value. Policy initiatives such as national highway expansion, industrial corridors, and housing projects are boosting copper consumption in India.

Copper in Indian Mutual Fund Portfolios: The New Favorite

Why Fund Managers Love Copper Stocks in 2025

- Strong Earnings Growth: Companies like Hindustan Copper posted a 52% YoY profit jump in Q4 FY25, reflecting robust demand and pricing power.

- Expansion Plans: Aggressive capex and global tie-ups (e.g., Hindustan Copper and CODELCO) signal long-term growth.

- Government Policy Support: “Atmanirbhar Bharat” and PLI schemes are encouraging domestic production and reducing import dependence.

- Diversification: Copper’s unique demand drivers make it a valuable diversifier alongside traditional sectors like banking or IT.

Copper-Related Mutual Fund Options

- Nippon India ETF Copper BeES: Tracks MCX copper futures, offering direct commodity exposure.

- Axis Copper Fund & Kotak Copper Fund: Invest in copper futures and stocks of copper producers, blending commodity and equity strategies.

- Equity Funds with Copper Stocks: Many diversified and thematic equity funds now hold stocks like Hindustan Copper, Vedanta, and Jindal Steel & Power, given their strong prospects.

Most Purchased Copper Stocks in Indian Mutual Funds (2024–2025)

|

Stock Name |

Key Sector Role |

Mutual Fund Presence |

Notable Highlights |

|

Hindustan Copper Ltd |

Mining, Smelting, Refining |

High (infra, PSU, thematic) |

Major expansion, PSU status |

|

Rajputana Industries Ltd |

Copper

products (tubes, rods) |

Moderate

(small-cap, thematic) |

Niche

industrial exposure |

|

Cubex Tubings Ltd |

Seamless copper tubes/rods |

Moderate |

Industrial/exports focus |

|

Madhav Copper Ltd |

Copper

strips, foils, rods |

Moderate |

Electrical

sector growth |

|

Precision Wires India Ltd |

Copper wires and cables |

Moderate |

Diversified sector funds |

|

Bhagyanagar India Ltd |

Copper

products, wires |

Moderate |

Manufacturing,

export |

Note: Always review the latest mutual fund factsheets and consult a financial advisor before investing, as sector allocations and stock holdings can change based on market dynamics.

How Copper Can Be a Game Changer for Retail Investors’ Wealth

- Potential for 30%+ Portfolio Growth by 2030: Global forecasts suggest copper prices could surge 20–30% or more as demand outpaces supply, offering significant upside for long-term investors.

- Long-Term Growth: With demand set to double by 2030 and supply struggling to keep up, copper offers significant upside potential.

- Inflation Hedge: Like gold and silver, copper can help protect portfolios from inflation, especially as infrastructure and electrification spending rises.

- Portfolio Diversification: Adding copper exposure reduces reliance on traditional asset classes and taps into the global green transition.

How Can Retail Investors Invest in Copper?

- Copper ETFs vs. Direct Commodity Investment

|

Feature |

Copper ETF (e.g., Copper BeES) |

Direct Copper (Commodity Futures) |

|

Access |

Buy/sell like a stock on NSE/BSE |

Trade via commodity exchanges (MCX) |

|

Minimum Investment |

Low (1 unit = 1 kg or less) |

Higher (lot sizes, margin requirements) |

|

Liquidity |

High (exchange traded) |

High, but requires active management |

|

Storage/Delivery |

No physical delivery |

Possible delivery on expiry |

|

Suitability |

Passive investors, SIP friendly |

Active traders, experienced investors |

|

Taxation |

As per equity MF/ETF rules |

As per commodity trading rules |

- Mutual Funds and Equity Exposure

- Invest in thematic or diversified mutual funds holding copper stocks.

- Choose funds with proven track records and transparent holdings.

- Direct Equity

- Buy shares of copper producers like Hindustan Copper, Vedanta, or Jindal Steel & Power via your brokerage account.

Guidance for Retail Investors

- Start Small: Begin with copper ETFs or mutual funds for easy, low-cost exposure.

- Diversify: Don’t put all your money in one metal—combine copper with other commodities or sectors.

- Monitor Trends: Keep an eye on global supply-demand, policy changes, and industrial growth.

- Consult a Financial Advisor: Ensure your copper allocation fits your risk profile and long-term goals.

Conclusion: Copper—The Red Metal Powering India’s Investment Future

Copper’s strategic importance in clean energy, infrastructure, and electronics is making it a top pick for Indian fund managers and retail investors alike. With robust price momentum, strong policy support, and innovative investment options like ETFs and mutual funds, copper is poised to be a game changer for wealth creation in the coming decade.

Don’t miss the copper wealth wave—consider adding copper to your diversified, future-ready investment portfolio and aim for 30%+ growth by 2030!

Disclaimer:

The content provided in these blogs is for informational and educational purposes only and should not be construed as investment advice, financial advice, or a recommendation to buy, sell, or hold any mutual fund, scheme, or security. The discussions and analyses are intended solely to foster awareness and understanding of various market situations and financial products. The information presented is based on publicly available data and sources believed to be reliable; however, its accuracy or completeness is not guaranteed.

Readers are expressly advised that they should seek independent professional advice from a qualified financial advisor before making any investment decisions. The author(s) and publisher of these blogs expressly disclaim any liability for any direct or indirect loss or damage of any kind arising out of or in connection with the use of or reliance on any information contained herein. Past performance is not indicative of future results, and all investments are subject to market risks.