Aggressive Hybrid Mutual Funds in 2025: Safer Growth During Market Volatility

Wondering how to balance market risk with long-term growth? Explore the top aggressive hybrid mutual funds in India for 2025. Get insights into performance, tax efficiency, and when to switch to equity funds

From Volatility to Stability: Using Aggressive Hybrid Funds Now and Planning Your Next Move

The Indian financial markets in 2025 are going through a particularly volatile phase, leaving many investors feeling uncertain and cautious. After years of steady growth, recent months have been marked by sharp swings in stock prices, driven by a complex mix of global and domestic factors. On the global front, persistent inflation, rising interest rates in major economies, and geopolitical tensions have unsettled markets worldwide. Meanwhile, India is facing its own challenges — from policy uncertainties following recent elections to fluctuating crude oil prices and a weakening rupee. These factors have led to increased market volatility, with benchmark indices like the Sensex and Nifty experiencing frequent ups and downs. This environment has left many investors wondering where to safely park their money without missing out on growth opportunities.

Why Aggressive Hybrid Mutual Funds Make Sense in 2025

In such uncertain times, aggressive hybrid mutual funds have emerged as a particularly attractive option. These funds offer a balanced approach by investing a significant portion—usually between 65% and 80%—in equities, while the remaining 20% to 35% is allocated to debt instruments. This blend allows investors to benefit from the growth potential of equities while the debt component provides a cushion against sharp market downturns. Compared to pure equity funds, aggressive hybrid funds tend to be less volatile, making them a suitable choice for investors who want to participate in market rallies but are wary of the risks involved in direct equity exposure.

Another advantage of aggressive hybrid funds is their tax efficiency. Since they maintain a minimum of 65% equity exposure, they qualify for the same tax benefits as equity mutual funds, which can be more favorable than debt-heavy alternatives. This makes them not only a safer choice during turbulent times but also a smart one from a tax perspective.

The Middle Ground for Conservative Equity Investors

Given the current market scenario, aggressive hybrid funds offer a middle ground for investors who want to stay invested in equities but also want some protection from volatility. They are especially suitable for conservative equity investors who are cautious but do not want to miss out on long-term wealth creation.

When and How to Shift from Hybrid to Pure Equity

However, it is important to remember that market conditions are always changing. When the volatility subsides and the market environment becomes more stable—with consistent economic growth, lower inflation, and reduced geopolitical risks—it might be time to rethink your investment strategy. At that point, you may want to gradually shift your investments toward pure equity funds or other specialized schemes that offer higher growth potential.

Making this transition smoothly requires careful planning. One effective way is to use a Systematic Transfer Plan (STP), which allows you to move your investments gradually from aggressive hybrid funds to equity funds. This approach helps reduce the risk of timing the market incorrectly by averaging out the entry price. Additionally, keeping track of key market indicators such as GDP growth, inflation rates, and volatility indices can help you decide the right time to make the switch.

Consulting a financial advisor before making any major changes is also advisable. A professional can help tailor your investment choices to your risk tolerance and long-term financial goals, ensuring that your portfolio remains aligned with your needs.

Top Aggressive Hybrid Funds to Watch in 2025

In conclusion, while the current market volatility can be unsettling, it also presents an opportunity to adopt a balanced investment approach. Aggressive hybrid mutual funds offer a resilient way to navigate uncertain times, blending growth with stability. And when the market shows signs of calm, shifting to other relevant schemes can help you capitalize on the next phase of growth. Staying informed and flexible is the key to successfully managing your investments through all market cycles.

ICICI Prudential Equity & Debt Fund

Here’s an in-depth, point-wise yet narrative elaboration of the three consistent performers in the aggressive hybrid mutual fund category: ICICI Prudential Equity & Debt Fund, DSP Aggressive Hybrid Fund, and HDFC Hybrid Equity Fund. Each is detailed on AUM, performance, asset allocation, investment style, and how they’ve outperformed their category and benchmarks, building trust for investors.

ICICI Prudential Equity & Debt Fund is the largest and one of the most trusted aggressive hybrid funds in India, managing a massive asset base of ₹42,340 crore as of June 2025. The fund has delivered a stellar 26.52% annualised return over the last five years and 21.42% over three years, consistently outperforming both its category and benchmark indices. Its asset allocation typically maintains 65–80% in equities—primarily large-cap stocks for stability—with the balance in high-quality debt and money market instruments, providing a cushion during market downturns. The fund’s investment style is a blend of growth and value, focusing on fundamentally strong companies and prudent sector diversification. This disciplined approach, along with active debt management, has enabled the fund to deliver strong risk-adjusted returns and lower volatility, making it a go-to choice for investors seeking both growth and safety in uncertain times.

DSP Aggressive Hybrid Fund

DSP Aggressive Hybrid Fund is another standout performer, managing an asset base of ₹10,829 crore as of June 2025. Over the last five years, it has generated an impressive 20.38% annualized return, with a three-year return of 20.14%—both well above the average for aggressive hybrid funds. The fund maintains around 66% allocation to equities, diversified across large-cap and select mid-cap stocks, while the rest is invested in government securities, high-quality corporate bonds, and cash equivalents. Its investment style is balanced, with a focus on quality and diversification across sectors like financials, consumer cyclicals, healthcare, and technology. The fund’s active management and disciplined risk controls have helped it outperform its category and benchmarks, especially during volatile periods, giving investors confidence in its ability to deliver consistent returns with managed risk

HDFC Hybrid Equity Fund

HDFC Hybrid Equity Fund, while not as large as the ICICI fund, is still a significant player in the space and is renowned for its steady performance and robust management. The fund typically allocates 65–80% to equities, with a preference for large-cap and quality mid-cap stocks, and the remainder in actively managed debt instruments. Its investment strategy combines growth and value, selecting fundamentally strong companies and maintaining prudent sector allocation. Historically, HDFC Hybrid Equity Fund has delivered returns that consistently exceed both its benchmark and category averages, particularly during periods of market stress. Its disciplined, research-driven approach and experienced management team have helped it maintain performance leadership and investor confidence, even in challenging market conditions3.

What sets these three funds apart is not just their size or past returns, but their resilience, adaptability, and proven ability to manage risk. Their balanced asset allocation helps cushion against market shocks while capturing growth during rallies. Consistently outperforming both category averages and relevant indices, they inspire trust among investors looking for a blend of growth and stability. While other aggressive hybrid funds like UTI, Edelweiss, and JM are also performing well, ICICI Prudential Equity & Debt Fund, DSP Aggressive Hybrid Fund, and HDFC Hybrid Equity Fund remain prime examples of why this category is a compelling option for investors navigating volatility in today’s market.

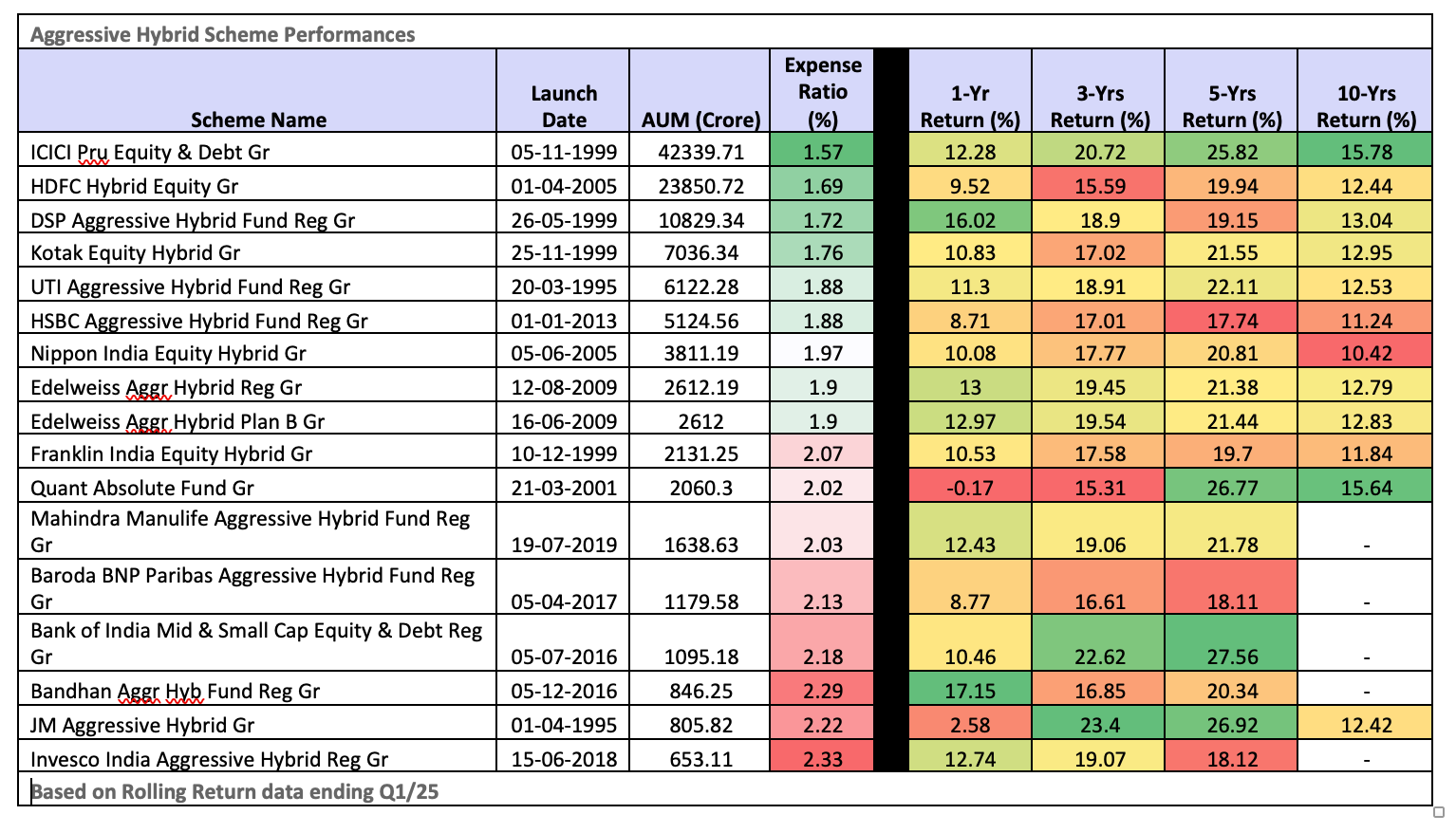

Fund Performance Table: Aggressive Hybrid Scheme Performances (Rolling Return Data Ending Q1 2025)

Disclaimer

To identify the most reliable mutual fund scheme, we have selected the Top 10 schemes in this category by evaluating their average rolling returns and the frequency with which they have outperformed their respective category averages.

Only those schemes with a proven track record of at least five years have been included in this analysis, as a sufficiently long history is essential to gauge how a fund performs across various market phases, including bull runs, downturns, and periods of stagnation. This approach ensures that only funds with demonstrated resilience and adaptability through different market cycles are considered.

Furthermore, to maintain credibility and ensure adequate liquidity, we have excluded schemes with assets under management (AUM) below ₹500 crore from our rankings. This threshold helps filter out smaller, potentially less stable funds, focusing our analysis on established schemes with a solid investor base.

The result is a list of the most consistent mutual fund schemes in this category—those that have not only delivered strong returns but have done so with remarkable regularity, making them worthy of consideration for discerning investors.